On March 10, 2025, the New York stock market experienced significant turmoil, with major indices closing sharply lower, leading investors to reassess their strategies amid growing economic concerns. The Nasdaq index fell by 4%, marking its most substantial decline since September 2022. These movements were heavily influenced by comments made by President Donald Trump during his interview with Fox News over the weekend, wherein he acknowledged the possible onset of economic recession stemming from his administration's tariff policies.

Specifically, Trump was asked if he anticipated the United States would face recession this year. His response was non-committal, stating, "I don't want to predict. It's transitional. It always takes some time to get there." This admission did little to instill confidence and instead triggered selling pressure across tech stocks, which are often viewed as vulnerable to economic downturns, especially when large investments slow down.

Leading this decline was Tesla, which saw its shares plunge by 15%, affecting the company's stock price significantly as it dropped to below half of its record high achieved three months prior. The electric vehicle maker faces additional challenges, with protests erupting at its nationwide stores, showcasing growing discontent among consumers and investors alike. Other major tech stocks, including Apple and Alphabet (the parent company of Google), also saw share prices fall approximately 5% amid concerns over their future performance.

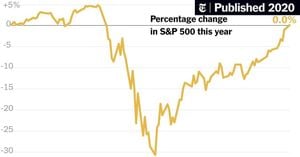

The overall sentiment pushed the Nasdaq down to 17,468.32 points, which has raised alarms about the broader tech sector's health. The S&P 500 index, which encapsulates 500 of the largest companies, similarly faced declines, dropping by 155.64 points (2.70%) to close at 5,614.56. The Dow Jones Industrial Average also registered significant losses, falling by 890.01 points (2.08%) to close at 41,911.71. Such widespread losses across these major indices reflect uncertainty and anxiety among investors who are wary of what lies ahead.

Adding to the concerns was the dramatic rise of the CBOE Volatility Index (VIX), commonly referred to as the ‘fear index.’ On March 10, VIX surged to 27.86, the highest level recorded since August 2024. This spike signifies increased market volatility and fear, which seemed to correlate with the uncertainty surrounding U.S. economic policies and the potential impact of tariff implementations.

Mike Musio, president of Investment Advisory Services, expressed concerns about the unpredictable effects of tariffs on both inflation and the economy. He stated, "There is uncertainty about how tariffs will influence prices and the economy. Concurrently, there are worries about growth rates slowing down." This sentiment was echoed by other financial advisors who pointed toward the historical patterns of market trends, where significant periods of adjustment can be expected during turbulent times.

Experts suggest investors remain cautious. While some promotional commentary indicates the possibility of market adjustments, long-term growth trends have shown positive returns overall because there have only been eight years since 2000 when the stock market did not see gains. They advise gradual purchasing for investors who seek to enter the market without succumbing to the panic selling evidenced lately.

The cascading sell-off coupled with fears of recession raises serious questions about the future of the economy as additional factors come to play. Concerns about government shutdown and related fiscal policies, key elements frequently discussed before, also factor heavily on investor sentiment. Markets could face turbulent days as Congress races to pass budget proposals to stave off shutdown scenarios.

Interestingly, other areas of the economy are also reeling from reactions to Trump’s tariff policies. For example, cryptocurrencies suffered as well. Bitcoin dipped below $80,000, matching levels observed just before Trump's election; other major cryptocurrencies followed suit, signaling widespread concern across various investment realms.

Analyzing these trends, Tom Hainlin, National Investment Strategist at U.S. Bank, noted, "A drop of this significance carries substantial weight, but it's often part of healthy market corrections typically seen during bullish periods." He pointed out, "Investors may be feeling cautious, but economic indicators have yet to show significant signs of recession. Hence, the situation may stabilize as clearer policy outlines emerge from the government."

Concerns among investors are not likely to dissipate entirely until there is greater clarity on economic policies affecting the current market. With uncertainties looming over both the U.S. economic outlook and relations with key trading partners, caution is the prescribed course for market participants as they navigate these choppy waters.