CONCORD, NH – New Hampshire residents are being warned about a new scam that aims to exploit E-ZPass users. The scam consists of fraudulent text messages misrepresenting themselves as legitimate communications from E-ZPass and falsely claiming that recipients have unpaid tolls.

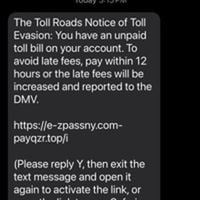

The scam text states that unless these supposed unpaid tolls are addressed promptly—specifically, within 12 hours—recipients face the threat of late fees and potential reporting to the Department of Motor Vehicles (DMV). This alarming tactic puts unwarranted pressure on individuals to make payments to avoid dire consequences, which could ultimately affect their vehicle registration.

Text messages from these scammers typically read like this: the recipient’s vehicle has an “unpaid toll bill,” coupled with a link to facilitate an immediate payment. However, these messages are nothing but an elaborate con designed to trick users into divulging personal information or making payments to the fraudsters.

New Hampshire Attorney General John Formella stressed the importance of skepticism regarding unsolicited messages. “This scam is a reminder for New Hampshire residents to be suspicious when receiving unsolicited text messages seeking payment of any kind,” he said. “If you receive an unsolicited text message seeking payment, assume that it is a scam, do not respond, and do not click any links contained within the message.”

Formella's advisory was echoed by Commissioner of Transportation William J. Cass, who clarified that the state’s E-ZPass system does not operate in such manners. “NH E-ZPass will never send text messages requesting toll payments or late fees. If you receive an unsolicited text or email, do not click the link. Always check your account through the official NH E-ZPass website or app to stay safe,” Cass added.

Additionally, the New Hampshire Division of Motor Vehicles (DMV) Director John Marasco mentioned that official notifications regarding toll payment defaults are communicated through USPS mail, rather than electronic text messages. “When the New Hampshire DMV learns from E-ZPass that a customer is in default of their toll payments, we notify that customer that a hold has been placed on their license plate registration via a letter sent through USPS mail – not by text message,” Marasco stated.

Residents are urged to remain vigilant and utilize caution when interacting with messages that may seem suspicious. The Attorney General’s office recommends checking account statuses through official channels such as the NH E-ZPass website (www.ezpassnh.com) or the official NH E-ZPass app available for download on the Apple App Store and Google Play Store.

If anyone has already fallen victim to this scam, it is crucial to act quickly. Individuals should consider alerting their banks or credit card companies to monitor or freeze their accounts. Additionally, they should change passwords for E-ZPass accounts, bank, and credit card logins to safeguard against potential identity theft.

“Phishing scams are designed to create a sense of panic, catching the receiver off guard and causing them to react before thinking,” warned DMV Director Amy Anthony, emphasizing the perpetual threat of digital fraud. Scammers often leverage minor amounts like $3.95 to $12.55 to encourage quick reactions from victims, making their schemes even more effective.

If you receive a fraudulent message or have any concerns regarding a suspicious text or email, you can report it to the FBI’s Internet Crime Complaint Center. For New Hampshire residents, reporting the incident can also be directed through the Attorney General’s Consumer Protection Hotline at 1-888-468-4454.

By remaining alert and aware, residents can help combat the threat posed by such scams and protect their personal information.

Residents are reminded that the threat of scams, especially those masquerading as official notifications, is continuously evolving. Therefore, it is essential to stay informed and cautious.

For further information about consumer protection or to report a scam, individuals can also visit the Attorney General’s Consumer Protection Bureau website.