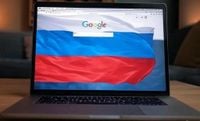

The Moscow Arbitration Court has taken a significant step in the ongoing battle between Google's Russian subsidiary and local media outlets, limiting the fine against the tech giant to a staggering 91 quintillion rubles. This ruling, which has drawn attention across the globe, is anchored in the recent bankruptcy declaration of Russian Google LLC, an event that, according to the court, marks a halt in the accumulating financial penalties stemming from the blocking of various local YouTube channels.

On October 18, 2023, Google LLC announced its bankruptcy, a declaration that compelled the Moscow Arbitration Court to scrutinize the financial practices and penalties levied against the company. Prior to this ruling, the sum associated with the penalties had been inflating incessantly every day. The penalty on that specific date was already pegged at 91.5 quintillion rubles, a figure that reflects the mammoth financial challenges faced by the corporation.

Fast forward to the end of January 2025, and the court confirmed that the fine had ballooned to dimensions exceeding ordinary comprehension: an eye-watering two duodecillion rubles—an amount sporting a staggering 39 zeros. For context, the total global wealth is estimated at just under $500 trillion, making Google’s financial obligations to local channels approximately 200 thousand times greater than this figure. Such a vivid contrast lays bare the intense financial climate in which Google is apparently entrenched.

In total, Google’s debt comprises claims from various Russian television channels, which include prominent names like Zvezda, Pervyi Kanal, VTRK (hosting networks like Russia 1 and Russia 24), along with others reported in claims against the corporation. Valeriy Talyarovskiy, the bankruptcy trustee overseeing these obligations, noted, "Всего в этом реестре 18 требований 16 кредиторов на общую сумму 91 квинтиллион 511 квадриллионов 687 триллионов 138 миллиардов 260 миллионов сто тысяч рублей."

This substantial claim represents the demands of 16 creditors bundled in the bankruptcy proceedings of the Russian Google subsidiary, emphasizing the overwhelming scale of the company's financial duress.

However, this legal scenario does not solely revolve around internal Russian regulations. In a related but distinct ruling, the High Court of England and Wales delivered a noteworthy judgment in January, barring the Russian channels including Russia Today, Spas, and Tsargrad from pursuing their lawsuits against Google in the UK. This decision, characterized as "нетипичная для английского правосудия позиция" by representatives involved, seems to shuffle the dynamics of international law affecting these media entities. Such decisions certainly signal a complex interplay between domestic policies and foreign jurisdiction in matters involving digital monopolies.

Total claims against Google related to blocked accounts on YouTube soared to an estimated astronomical sum of 1.81 duodecillion rubles, fundamentally illustrating the tensions that have arisen from the impediment of broadcasting capabilities for local media. The fixed nature of the Russian subsidiary's debt is contrasted sharply against the ongoing, unceasing obligations of Google's American parent company. This duality suggests a marrying of new-age digital regulations with time-honored bankruptcy laws, offering a rare glimpse into the depths of corporate responsibilities and ethical obligations entangled in a highly competitive global market.

Many legal experts believe that the situation might not remain stagnant for long. Ongoing lawsuits promise to unfold further developments, and reactions from counterparts in other jurisdictions may evolve as this unfolding drama captures international interest. As media outlets churn out coverage of this unprecedented monetary scale, stakeholders across the spectrum are assessing their positions; for now, these legal ramifications continue to prompt discussions about freedom of press and digital governance.

In a world where advances in technology increasingly collide with historical financial norms, cases like this compel regulatory bodies and courts to rethink and redesign their approaches to digital management and corporate structures. Will we see new frameworks emerge to address such overwhelming debts? Only time will tell.