On April 7, 2025, Mitsubishi UFJ Bank announced a significant update regarding the dollar-yen exchange rate, setting the midpoint at 145.78 yen. This figure represents a decrease of approximately 25 sen from the previous business day's rate of 146.03 yen, indicating a strengthening of the yen against the dollar. This news comes amidst broader market fluctuations affecting various sectors, including banking and real estate.

In the financial sector, bank stocks, notably those of Mitsubishi UFJ Financial Group, experienced a sharp decline. Reports indicate that Mitsubishi UFJ and Sumitomo Mitsui Financial Group saw their shares drop by 21% and 18%, respectively, at one point during trading. Mizuho Financial Group also faced a significant decline of 18%. The TOPIX bank index fell by 17% at one point, reaching its lowest level since August 2024. Analysts, including Yutaka Miura from SBI Securities, suggested that the bank sector index had lost the gains of the past year within just three days, raising concerns that the stocks might be oversold. Miura emphasized the need for calm, stating, "It is important not to panic. We need to assess whether the impact of U.S. tariff policies will significantly affect Japanese banks."

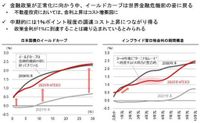

Meanwhile, Mitsubishi UFJ Trust and Banking Corporation released its Real Estate Market Research Report Vol. 277, which discusses the implications of normalizing interest rate structures on real estate investment returns. The report suggests that as financial policies stabilize, the yield curve may revert to its pre-global financial crisis form. It also indicates that the risk premium for real estate investments could decrease due to increased transaction liquidity. Interestingly, the report posits that even with a 1% increase in interest rates, the corresponding rise in interest costs would likely be offset by an increase in office rents.

In a related development, FUNDINNO Co., Ltd., in collaboration with Mitsubishi UFJ Trust and Banking Corporation, announced a new feature on their MUFG FUNDOOR platform. This feature is designed to support a stock management scheme that allows companies to manage their own shares, particularly in light of recent tax reforms concerning stock options. This new functionality aims to facilitate the exercise of tax-qualified stock options before companies go public, thereby providing a more flexible environment for startups to attract and retain talent.

The MUFG FUNDOOR platform is a comprehensive management tool for unlisted companies, streamlining various corporate governance tasks, including the management of stock options, shareholder meetings, and communication with stakeholders. This enhancement is expected to ease the administrative burden on companies, particularly startups that may have limited resources.

As of October 31, 2024, FUNDINNO reported a total capital and capital reserve amounting to 9,870,377,024 yen, highlighting its significant role in Japan's venture capital landscape. The company is focused on democratizing access to investment opportunities, ensuring that entrepreneurs and investors can bridge the information and opportunity gap.

In the context of these developments, market observers are closely monitoring the impact of U.S. economic policies on Japan's financial landscape. The uncertainty surrounding U.S. tariffs has raised questions about its potential effects on Japanese banks and the broader economy. As the situation evolves, stakeholders are advised to remain vigilant and informed.

Overall, the financial landscape in Japan is undergoing notable changes, driven by both domestic developments and international influences. The adjustments in the dollar-yen exchange rate, the performance of bank stocks, and the innovations in stock management platforms reflect a dynamic environment that requires careful navigation by investors and companies alike.

![上場ETN(発行者:三菱UFJ証券ホールディングス株式会社)に関する日々の開示事項 投稿日時: 2025/04/07 11:30[適時開示] - みんかぶ](https://thumbor.evrimagaci.org/cEg-HAY18cc5so29LmKUvQnoLEQ=/200x0/tpg%2Fsources%2F06c4cf74-5869-4a8a-84c2-a2a9ef8d50e4.jpeg)