On April 7, 2025, the Milan Stock Exchange, known as Piazza Affari, faced severe declines as financial markets across Europe reacted negatively to the recent imposition of tariffs by former U.S. President Donald Trump. The FTSE MIB index plummeted by 6.17% in early trading, reflecting a broader trend that saw the entire European market lose nearly 890 billion euros in just under three hours of trading.

The turmoil began when Trump announced new tariffs on imports into the United States, a move that has sent shockwaves through global markets. The Milan exchange, which had previously gained over 10 percentage points since the start of the year, saw its gains shrink to a mere 1.35% after the tariffs were imposed. The significant drop in Milan's stock market is attributed to several factors, including its heavy reliance on financial stocks and the adverse effects of declining interest rates from the European Central Bank (ECB).

Market analysts have pointed out that Piazza Affari is particularly vulnerable due to its composition, which is heavily weighted towards the banking sector. As financial stocks have taken a hit, the overall market has struggled to maintain stability. Notably, the DAX index in Frankfurt, which lacks the same number of financial stocks but benefits from a robust defense sector, has also experienced significant declines, dropping by 8.30%.

In the wake of these developments, the spread on Italian government bonds surged to 130 basis points, up from 119 on the previous Friday, reflecting increased investor anxiety. The yield on the 10-year BTP reached 3.75%, further compounding the challenges facing the Italian economy.

As the trading day progressed, the FTSE Italia All Share index fell by 5.56%, while the FTSE Italia Mid Cap and FTSE Italia Star indexes dropped by 4.82% and 4.9%, respectively. The banking sector was particularly hard hit, with major players like UniCredit and IntesaSanpaolo experiencing declines of 5.68% and 7.19%, respectively. Other notable losses included Monte dei Paschi di Siena, down 7.38%, and Popolare di Sondrio, which fell by 7.62%.

Furthermore, energy stocks were also affected, with ENI seeing a drop of 6.44% to 12.212 euros per share, while Saipem and Tenaris followed suit with losses of 6.54% and 5.59%, respectively. The decline in oil prices, which fell to $59.77 per barrel, has compounded the challenges for these companies.

Market sentiment remains pessimistic as fears of a global recession loom large. The Asian markets echoed this sentiment, with Hong Kong's Hang Seng index plummeting by 13.22%, marking its worst session since the 1997 financial crisis. These developments have raised concerns about a potential trade war and its implications for global economic stability.

Despite the significant downturn, financial experts advise against panic selling, emphasizing that historical trends indicate markets eventually rebound. The potential of unrealized losses remains as long as investors hold their positions. "Sometimes you need to take medicine to solve a problem," Trump stated, justifying the tariffs that have caused such upheaval.

The situation in Europe is precarious, with markets reacting to both the immediate effects of the tariffs and the long-term implications for trade relationships. Italy, as a significant exporter with a trade surplus second only to Germany in Europe, faces unique challenges. The retaliatory measures from China and the looming threat of a trade blockade have placed Italian businesses in a difficult position.

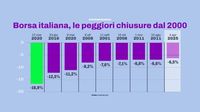

As the day unfolded, the FTSE MIB index fluctuated between a low of 31,946 points and a high of 34,305 points, ultimately closing down at 32,050 points, a staggering 7.6% drop. The financial markets are still reeling from the effects of Trump's tariffs, and analysts warn that further declines could be on the horizon as the economic landscape shifts.

The overall sentiment in Europe remains grim, with analysts closely monitoring the situation. The Stoxx 600 index, which tracks stocks across Europe, was down 5.86%, reflecting the widespread impact of the tariffs. Countries like France and Spain also reported significant declines, with Paris down 5.56% and Madrid down 5.33%.

As investors brace for potential further declines, the focus will be on how governments respond to stabilize their economies and mitigate the effects of the tariffs. The coming days will be crucial in determining the trajectory of the markets and the broader economic implications of these trade policies.