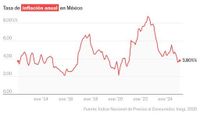

On Wednesday, April 9, 2025, Mexico's inflation reached 3.80% annually, according to the National Consumer Price Index (INPC) reported by the National Institute of Statistics and Geography (Inegi). This figure marks a 0.31% increase in March compared to February, indicating the second consecutive month of rising prices. The underlying inflation, which reflects the medium to long-term trajectory of general inflation, also rose, showing a monthly increase of 0.43% and reaching 3.64% at the end of March.

Inside this indicator, the prices of goods reported an annual increase of 2.98%, while services experienced a higher rate of 4.35%. The rising costs of food continue to be a significant concern, with food prices increasing to 4.15% annually, surpassing the general inflation rate. Meanwhile, non-core inflation, which includes government-regulated prices, showed a slight decrease of 0.08% in March, reaching 4.16% annually. Within this category, agricultural products recorded a monthly increase of 0.41%, culminating in an annual rate of 4.87%.

Gabriela Siller, the director of economic analysis at Grupo Base, noted, "Mexico's inflation could be pressured upward in the goods subcomponent due to rising prices in the United States with the implementation of reciprocal tariffs." The impact of these tariffs, particularly on food items, is evident. Among the products that saw significant price hikes were lemons, which soared by 20.75%, green tomatoes by 17.56%, avocados by 7.16%, and beef by 3.26%.

This inflationary trend comes amid a backdrop of economic uncertainty, particularly due to the ongoing trade tensions and tariffs imposed by the United States. Analysts have pointed out that the economic slowdown in Mexico has led the Bank of Mexico (Banxico) to reduce borrowing costs. In March, the central bank implemented a sixth consecutive cut, lowering the interest rate by 50 basis points to 9%. This decision was unanimous among the board members, who indicated that further cuts of similar magnitude could be forthcoming.

According to Pamela Díaz Loubet, an economist at BNP Paribas, the inflation data released on Wednesday could provide Banxico with the leeway to continue this trend of monetary easing. She anticipated additional cuts of 50 basis points in May and June, given the bank's forward guidance. "There is room for further cuts," Díaz Loubet stated prior to the inflation data release. "It is true that we are not seeing a total decline in activity in the economic data, but since the fourth quarter of last year, we have observed a significant loss of economic dynamism."

While Mexico was one of the few countries exempted from the retaliatory tariffs imposed by former President Donald Trump, it still faces challenges from tariffs on automobiles—its primary exports to the U.S.—as well as tariffs on steel and aluminum. Additionally, products not covered by the trade agreement between the U.S., Mexico, and Canada are also affected.

The most recent survey from Citi’s research unit revealed a downward revision in GDP estimates for 2025, from 0.60% to 0.30%, and for 2026, from 1.7% to 1.5%. Analysts are now forecasting an inflation rate of 3.78% by the end of this year and into the next.

As the inflationary pressures continue to mount, the Mexican government and economic policymakers are tasked with navigating a complex landscape marked by external economic influences and domestic price pressures. The ongoing adjustments in monetary policy reflect a responsive approach to these challenges, aiming to stabilize the economy while addressing the immediate concerns of rising prices for consumers.

The situation remains fluid, and as the global economy evolves, Mexico’s inflation trajectory will likely be shaped by both domestic actions and international developments. The interplay between these factors will be crucial in determining how consumers and businesses adapt to the changing economic environment.