On Monday, March 3, 2025, U.S. stock markets faced significant turmoil as major indices saw substantial declines triggered by President Donald Trump's announcement of impending tariffs on imports from Canada and Mexico. The Dow Jones Industrial Average fell nearly 650 points, closing down 649.67 points or 1.5%, marking one of the toughest trading days of the year.

The S&P 500 fell by 1.8%, reaching its worst performance of 2025, with losses amounting to 104.78 points, bringing the total down to 5,849.72. The tech-heavy Nasdaq Composite witnessed declines of 2.6%, dropping to 18,350.19 points by the end of the trading session. This collective sell-off indicated growing investor concern over the financial impacts of Trump's tariff policies as they gained momentum.

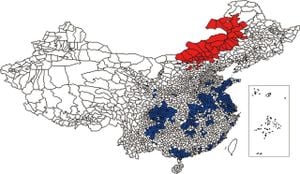

Trump confirmed during the day’s trading, “There’s no room left for Mexico or for Canada,” solidifying the prevailing sentiment of uncertainty among traders. The tariffs, which are effective at 12:01 AM on March 4, 2025, are set at 25% for both countries, alongside additional measures anticipated against Chinese goods, which will increase from 10% to 20% imminently.

These developments come as Wall Street hoped for some last-minute changes or negotiations; instead, Trump's outright dismissal of negotiations sent investors scrambling and significantly impacted numerous sectors. Tech stocks suffered particularly; Nvidia shares plummeted over 8%, underscoring the tech sector’s vulnerability amid these tariff threats. Other major tech stocks, including Tesla and Amazon, also reported declines of 2.8% and 3% respectively.

The prevailing mood was exacerbated by freshly released economic data which showed U.S. manufacturers' supply costs had surged as inflation fears mounted. Reports from the Institute for Supply Management revealed the manufacturing PMI had fallen to 50.3 from 50.9, indicating only marginal growth. More troubling was the sharp drop in new orders, which fell more than 6 points to 48.6, signaling potential contraction.

“Demand eased, production stabilized, and destaffing continued as panelists’ companies experience the first operational shock of the new administration’s tariff policy,” stated Timothy Fiore, Chair of the Institute for Supply Management, indicating challenges manufacturers are already facing due to the looming tariffs.

Market analysts have voiced concerns about the ramifications of these tariffs on the broader U.S. economy, particularly with GDP estimates already taking notable hits. The Atlanta Fed's GDPNow model has revised its first-quarter growth projection down to -2.8% from previous estimates of only -1.5% growth. The economic backdrop paints a worrisome picture as retail earnings are expected to reveal consumer resilience—an indicator traders will be closely watching.

Stocks tied to the cryptocurrency economy also faced volatility on Monday. President Trump had previously announced plans for the U.S. to establish a strategic reserve of cryptocurrencies, which initially spurred prices. Bitcoin, which had spiked following the announcement, was trading around $86,000 after retreating from higher gains earlier.

The day’s market declines underscored not only the immediate impact of the tariffs but also highlighted the investor hesitance toward the Trump administration’s economic policies. Concerns around inflation, levies, and the federal response to economic pressures pose serious questions about the future economic climate.

Across the Pacific, manufacturers reported renewed orders as companies rushed to beat higher tariffs, fueling speculation about retaliatory actions from China as the geopolitical tensions escalated. Meanwhile, European markets reacted positively, with stocks surging amid discussions of increased military spending following recent geopolitical developments.

Market experts are also gearing up for upcoming job reports, as this week’s labor figures are anticipated to provide valuable insight about the resilience of the U.S. economy. With reports on nonfarm payrolls and retail sector earnings scheduled for release, questions loom about the economic outlook against the backdrop of looming tariffs.

President Trump’s aggressive tariff stance has sparked widespread debate. With falling stocks and rising costs predicted, some fear these policies could destabilize the recovery narrative many market participants hoped for after the tumultuous effects of the global health crisis. How these actions will reshape the economic forecast remains to be seen, as the financial ramifications are likely to continue influencing markets and consumer sentiment alike.