March 2025 has brought a mixed bag of signals for investors as they navigate the tumultuous waters of the stock market. The TMC Research VIX Risk Indicator recently fell to -1.6, a sign that suggests that stock market volatility might remain subdued in the near term. This four-month low implies that investors could see a relatively calm market without significant corrections ahead, at least for the next week or two.

According to TMC Research, which is the research arm of The Milwaukee Company, this reading below zero indicates a low/moderate expected probability for a significant stock market correction. Indeed, this is a reassuring development for many market watchers who have been concerned about volatility following recent market upheaval. The VIX risk index is designed to forecast the forthcoming market state, and its drop is a welcome sight.

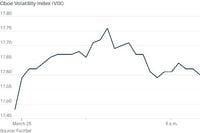

However, amidst this optimism, a counteracting force emerged on March 25 when the Cboe Volatility Index (VIX) climbed 0.6% to just below 18. For many investors, such an increase raises a few alarms. Typically, readings below 20 are seen as indicative of low market volatility, but this uptick introduced a hint of anxiety related to ongoing concerns over United States trade policies under President Donald Trump. As trade policies continue to hang in the balance, many fear that uncertainty could keep the VIX elevated, dampening confidence in the market.

Market analysts believe that these oscillations stem from geopolitical concerns, particularly regarding tariffs. Reports surfaced suggesting that the White House might consider rolling back some tariffs. Nonetheless, investors remain wary, as they await the much-anticipated “Liberation Day” on April 2, the day many of Trump’s tariffs are set to take effect. As a result, the volatility landscape remains unpredictable, stressing the importance of monitoring ongoing developments.

Investors seeking to hedge against volatility or even profit from it have recently found new options thanks to JPMorgan Chase’s launch of the Inverse VIX Short-Term Futures ETNs (VYLD). This innovative product aims to provide exposure to the daily returns of an index shorting futures tied to the VIX. Notably, this ETN aims to increase by 1% for every point decrease in VIX futures—a strategic shift designed to mitigate risks significantly compared to previous investment structures that were heavily leveraged.

During the infamous “volmageddon” of 2018, many investors faced staggering losses—over 90% in value—when the VIX surged dramatically. This history laid the groundwork for JPMorgan's consideration to focus on point changes rather than percentage changes in their new ETN structure; a decision that lowers risks associated with extreme volatility fluctuations.

However, industry experts like Bryan Armour, director of passive strategies research at Morningstar, caution investors about getting too excited about these new products. He notes that while the current ETN structure appears safer compared to its predecessors, it may complicate its use as a hedge against broader market movements. In essence, the product operates on a different principle compared to conventional hedges, which limits its potential applications.

Furthermore, Aniket Ullal, head of ETF research at CFRA Research, remarked, “In 2025, it is likely we will see more equity volatility relative to 2024.” His observation directly links the uptick in volatility seen earlier in the year with broad economic patterns and the lingering effects of external uncertainties. While these developments indicate cautious optimism among investors, they also underscore the unpredictable nature of market movements.

The volatility landscape is undoubtedly fraught with apprehension and opportunity alike. As investors prepare for the weeks ahead, the blend of analyses, tools, and strategies available grants them the ability to navigate this precarious environment. Whether it’s the recent VIX Risk Indicator showing signs of promise or adjustments to volatility products, most are keeping their eyes firmly on the horizon while still understanding the value of remaining vigilant.

As we move towards April, the market remains in a critical phase. With the continued uncertainty surrounding tariffs and the potential economic ramifications, combined with evolving volatility trading tools, the coming weeks could be pivotal for traders and investors alike. The optimism from TMC Research’s indicators contrasts sharply with rising anxieties over political maneuvering, presenting a duel of prospects that will inevitably shape market activity.

Overall, the landscape in March 2025 is a tale of two narratives—embarking on a potential journey towards stability while being tethered down by looming uncertainties. For those willing to balance their portfolios wisely and stay abreast of the shifts in volatility, opportunities may yet await.