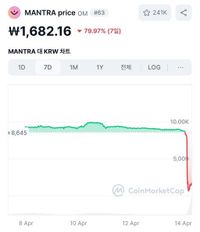

On April 13, 2025, the price of the Mantra (OM) token, a cryptocurrency linked to real-world asset tokenization, plummeted by over 90%, sending shockwaves through the market. The token, which had been trading at approximately $6.30, fell to below $0.50, resulting in a loss of more than $600 million in market capitalization.

This dramatic decline has led some traders to label it as a potential 'rug pull,' a term used to describe situations where developers abandon a project and take investors' funds. Market investor Gordon expressed his concerns on social media, stating, "If the team does not clarify this situation, OM could very well head to zero. This might be the largest rug pull since Luna or FTX." His comments reflect the heightened anxiety among investors regarding the future of the token.

As of now, the exact cause of the OM token's price collapse remains unclear. The incident is part of a troubling trend in early 2025, which has seen several high-profile token failures and cybersecurity incidents, including the collapse of the Libra meme coin and a $14 million hack of the Bybit exchange, resulting in significant investor losses.

Mantra, which specializes in tokenizing physical assets, had recently entered into a $100 million agreement with the Dubai-based conglomerate DAMAC to tokenize real estate and data centers on its blockchain. In February 2025, Mantra also secured a virtual asset service provider license from Dubai's Virtual Assets Regulatory Authority (VARA), allowing it to operate legally in the UAE and offer various digital asset services.

The timing of the token's collapse raises questions, especially given the recent partnership with DAMAC, which aimed to provide innovative fundraising solutions for real estate developers and investors. The ability to complete transactions quickly and cost-effectively across borders has made tokenization an appealing option for many in the investment community.

In light of the recent turmoil, the Mantra community has expressed growing distrust towards the project's management. The community lead, Dustin McDaniel, communicated via Telegram that the team was assessing the situation and denied any allegations of premeditated sell-offs. However, access to Mantra's public Telegram channel was reportedly blocked, further fueling skepticism among investors.

In a bid to address the situation, Mantra took to its official X (formerly Twitter) account to clarify that the price drop was due to forced liquidations rather than any internal issues. Co-founder John Patrick Mullin stated, "A large investor experienced a significant liquidation on a centralized exchange, and we are working to resolve this matter." Despite these assurances, the community remains on edge, with many demanding more transparency and accountability from the project's leadership.

As the situation unfolds, experts warn that the fallout from the OM token's collapse could have broader implications for the real-world asset (RWA) tokenization sector. The potential loss of confidence among investors in this space could hinder future projects and innovations.

On April 14, 2025, Mantra reiterated its commitment to transparency, stating, "We are fundamentally a sound project, and this incident was caused by indiscriminate liquidation, not by any actions of our internal team." They promised to investigate the circumstances surrounding the liquidation and share findings with the community.

JP Mullin also emphasized that the Telegram community had not been deleted and that all team holdings were securely stored in designated addresses. He assured investors that the team is still present and actively working to resolve the issues at hand.

Despite these reassurances, the road to recovery for the OM token and the Mantra project appears fraught with challenges. Investors have voiced that without responsible explanations and concrete actions, regaining their trust may prove difficult.

The OM incident serves as a stark reminder of the volatility inherent in the cryptocurrency market and raises critical questions about investor protections and the responsibilities of project teams. As the dust settles, the future of Mantra and its token remains uncertain, with many watching closely to see how the situation develops.

In the coming weeks, the response of Mantra's management will be crucial in determining whether they can restore confidence among their investors and the broader market. The outcome could very well shape the future landscape of RWA-based projects and their acceptance in the investment community.