Macy's, the iconic American department store, recently found itself embroiled in controversy following shocking revelations about fraudulent expense reporting by a former employee. The retail powerhouse announced it would delay its third-quarter earnings report, moving it from November 26 to December 11. This postponement is connected to an internal investigation aimed at unraveling the web of deceit tied to millions of manipulated expenses.

At the center of this scandal is the accusation against a former employee responsible for managing small package delivery expenses. Reports suggest this individual engaged in systematic accounting manipulation, executing what are described as "intentional erroneous accounting accrual entries". These entries reportedly disguised between $132 million and $154 million of delivery expenses covering the period from the fourth quarter of 2021 through the fiscal quarter ending November 2, 2023.

To provide some clarity, during this same period, Macy’s reported total delivery expenses amounting to $4.36 billion. This means the concealed expenses represent about 3% to 3.5% of total delivery costs. Despite the magnitude of the fraud, Macy’s CEO Tony Spring reassured stakeholders, stating these accounting discrepancies had no bearing on cash flow or vendor payments. This assurance reflects Macy’s commitment to transparency and ethical conduct, as highlighted by Spring’s statement about fostering a culture of integrity within the firm.

While Macy’s has been relatively quiet about the specific techniques used to facilitate this fraud, insights from industry experts have begun to surface. For example, Adriana Carpenter, CFO of the software company Emburse, elaborated on the nature of the discrepancies. She hypothesized the accountant altered the coding for delivery transactions, reallocations intended to divert payments to balance sheet accounts instead of profit and loss statements. This maneuver effectively meant the payments were recorded as cash outflows without ever being reflected as expenses.

Carpenter suggested two likely scenarios for how this adjustment might have occurred. One possibility is the coding was changed during the initial transaction process, meaning the errors took place at their inception. Alternatively, it could have happened through subsequent journal entries where the original profit and loss records were reversed, transferring those expenses to the balance sheet instead. She emphasized the necessity of implementing comprehensive expense management tools to prevent such manipulations from occurring again.

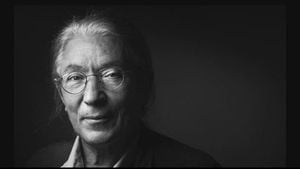

Commenting on the psychological factors feeding such fraudulent actions, Jo-Ellen Pozner, associate professor of management at Santa Clara University's Leavey School of Business, pointed out the frequent occurrence of accounting discrepancies within many organizations. She suggested the employee's motivation might stem from performance-based incentives - if they had financial rewards tied to cost reductions or profitability increases, they could be inclined to hide expenses. Pozner expressed concerns about how organizations sometimes create incentives which, instead of promoting ethical behavior, encourage misconduct. She also noted the shared responsibility for such fraud, which can involve multiple individuals from financial managers to executives. Unfortunately, as often happens, the consequences usually fall onto just one or two individuals, raising questions about the accountability of the broader system.

This turmoil at Macy’s arrives at a precarious time for the retailer. The company has been undergoing significant strategic changes, including termination of discussions with potential private equity buyers. Recently, it has embarked on what executives are calling their “Bold New Chapter” plan, aimed at revitalizing the Macy’s brand. CFO Adrian Mitchell described these efforts as necessary after several years of decline, which includes closing 150 underperforming stores over the next three years.

Even amid these challenges, Macy’s remains focused on stores identified as having growth potential—specifically 350 locations. Out of these, 50 stores are being designated as experimental grounds for new strategies intended to rejuvenate sales and customer engagement.

Initial reports from the upcoming third-quarter results show mixed emotions. There was noted to be a 2.4% drop year-over-year in net sales. Nevertheless, analysts like David Swartz from Morningstar highlight some optimistic signs, including a 1.9% increase for same-store sales at the top 50 Macy’s locations and significant growth at Bloomingdale’s and Bluemercury, which saw over 3% increase. Swartz noted, "We regard these results as supportive of its 'A Bold New Chapter' plan."

Turning back to the expense reporting scandal, analysts appear to be treating the situation with measured expectations. Swartz commented on the accounting incident, stating it seems limited and won't have long-term negative repercussions. He emphasized the overall operational expenses at Macy’s far outweigh the discrepancies tied to this fraud case. With annual operating expenses exceeding $8 billion, he believes investors will likely focus on Macy's strategic execution rather than this isolated issue.