On April 7, LG Electronics announced its provisional earnings, reporting consolidated revenue of KRW 22.7447 trillion and an operating profit of KRW 1.259 trillion for the first quarter of 2025. This revenue marks a 7.8% increase year-over-year, making it the highest-ever first-quarter revenue for the company. However, operating profit saw a decline of 5.7% compared to the same period last year.

This is the first time LG Electronics has surpassed KRW 22 trillion in Q1 revenue. A company official explained, "Despite continued uncertainties in the business environment such as the economic downturn, the company achieved record-high revenue thanks to stable growth in core businesses and qualitative growth in B2B, subscription, and webOS-led Non-HW (non-appliance) direct-to-consumer (D2C) sectors." The official noted that increased revenue from high-margin sectors contributed to a stable profit structure, aided by efficient resource allocation, stabilized raw material and logistics costs, and flexible global production operations.

The main driver of revenue growth was LG’s flagship home appliance division, which maintained a strong foothold in the premium B2C market. B2B businesses, including built-in appliances and component sales, also played a significant role in the company’s performance. Subscription services that combine products and services are rapidly expanding, with LG planning to enhance its subscription-optimized product lineup and care services while increasing its presence in overseas subscription markets.

Furthermore, LG’s media and entertainment business is set for synergy, as the company has integrated its display-based operations—including TVs, IT (laptops and monitors), and commercial displays—to strengthen its webOS-based advertising and content business. The company recently launched its 2025 TV lineup, featuring significantly enhanced AI capabilities across content recommendation, picture, and sound quality, aiming to boost market competitiveness. An LG official remarked, "New releases such as the ultra-lightweight AI-powered LG Gram Pro laptop and the lifestyle screen LG StanbyME 2 are also receiving positive feedback." The commercial display segment continues to secure major overseas contracts.

However, analysts have pointed out LG Electronics’ continued reliance on its home appliance business this year. They assess that the second quarter will serve as a true litmus test, as the surge in appliance demand may have been a temporary phenomenon ahead of tariff policies implemented by the Trump administration in the United States. Park Sang-hyun, a researcher at Korea Investment & Securities, stated, "The main factor behind LG’s Q1 results appears to be ‘pull-in demand’ from consumers looking to purchase before price hikes due to U.S. tariffs. Meanwhile, the VS (Vehicle Solutions) and BS (Business Solutions) divisions likely underperformed due to slower EV demand and delayed visibility of new business results." He continued, "Q2 earnings will serve as a test of LG’s ability to respond to tariffs. Given LG’s profit structure, raising product prices due to expanded tariffs seems inevitable. The company must implement a delicate pricing strategy that minimizes volume decline to protect its Q2 results."

As for full-year performance, he noted, "Downside risks are limited," but added, "Tariff response capabilities must be proven in Q2, and B2B and Non-HW contributions in Q3–Q4 must reduce earnings volatility." LG is focusing on diversifying its business portfolio, with a core future growth strategy centered on the vehicle component sector, particularly in-vehicle infotainment (IVI). The company aims to expand sales of high-value-added products and diversify its business model into areas such as vehicle content platforms.

Its affiliate, LG Magna e-Powertrain, is working to establish a competitive edge based on differentiated technologies in motors and inverters while improving operational capabilities at overseas production sites. The vehicle lighting division is accelerating next-generation product development, including high-resolution and intelligent lighting, while focusing on improving business efficiency.

In the HVAC (Heating, Ventilation, and Air Conditioning) business, which is being developed as a core B2B unit, LG expects to surpass its performance in Q1 2024 (revenue: KRW 2.589 trillion; operating profit: KRW 335.6 billion). As a project-based business, LG is enhancing profitability by operating as an independent division tailored to the nature of its clients and business. An official added, "LG is securing major contracts in commercial HVAC systems by offering localized solutions optimized for climate, architecture, and residential trends, especially in markets like Singapore."

In the residential HVAC segment, LG continues to lead with AI-driven innovations. The growing sales of the AI-enabled LG Whisen stand-type air conditioner have led the company’s production lines in Changwon, South Gyeongsang Province, to reach full capacity earlier than expected. The provisional results released are based on Korean International Financial Reporting Standards (K-IFRS). LG Electronics plans to announce detailed net profit figures and business division performance for Q1 2025 at its earnings conference later this month.

Meanwhile, on April 4, 2025, Minix's "The Plender Pro" food processor sold out at the beginning of a broadcast on GS Home Shopping. At Home had tripled its preparation volume last month, when 1,000 units were sold within 30 minutes on Naver Shopping Live. An official from Minix stated, "We recently released an upgrade product that is easy to manage as food processors are in the spotlight as marriage and home appliances, but the sales speed is fast from the beginning."

The food appliance industry is entering a competitive phase, particularly with the increase in food processor purchases during spring and summer, when odors worsen. Local governments are also providing subsidies for food processors in the first half of the year, prompting new products to be released to capture consumer interest. Kuchen launched a dry pulverized food processor called "Zerobin" earlier this month, while Cuckoo's new "microbial food processor," launched in February 2025, features a deodorizing system that controls odors by decomposing 1.3 billion microorganisms. Cuckoo has seen sales of food processors increase by over 50% year-on-year since 2021.

In addition, Smart Cara launched the "Smart Cara 400SE" last month, which reduces food volume by 94%. Minix has been selling "The Plender Pro" since last month, which has cut the drying time by more than 80 minutes compared to its predecessor. The Smart Cara 400SE is priced around 620,000 won, nearly half the cost of the Blade X, which was launched last year.

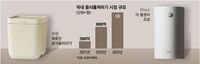

The food processor market is projected to grow rapidly from 200 billion won in 2021 to 1 trillion won this year. Classified as a "household liberation" appliance that alleviates consumer inconveniences similar to robot vacuum cleaners and dishwashers, food processors are popular among single-person households. The demand for replacements is steady as newer models boast improved functions over initial products.

At Today's House, a lifestyle platform, search volume for food processors increased by 46.4% year-on-year from January to March. Another reason the industry is focusing its efforts in the spring is due to local government purchase support projects, which will conclude in the first half of the year. Each local government supports up to 50% of purchase costs to reduce food waste in homes. For example, Songpa-gu in Seoul will provide up to 280,000 won for applications covering 40% of the purchase price of food processors by April 25, 2025, while Gangnam-gu will subsidize up to 350,000 won until April 18, 2025.

However, eligibility for these subsidies is limited to products that have received quality and safety certification, so consumers must check their products before making a purchase.