On October 13, 2025, two of South Korea’s industrial powerhouses—LG Electronics and LG Energy Solution—released their third-quarter earnings, revealing a tale of resilience, strategic pivots, and the unpredictable impact of global policy shifts. While both companies faced headwinds from tariffs, shifting consumer sentiment, and regulatory disruptions, their ability to adapt has kept them competitive on the world stage.

LG Electronics, long renowned for its home appliances and television sets, reported tentative consolidated third-quarter sales of 21.8751 trillion won and an operating profit of 688.9 billion won. While these figures represented a year-over-year decline of 1.4% in sales and 8.4% in operating profit, the numbers still exceeded market expectations by a notable 10%. According to The Korea Economic Daily, this made for the second-highest third-quarter sales in the company’s history—a testament to the company’s strategic agility in a tough market.

But the road to these results wasn’t exactly smooth. The home appliance division, a core pillar of LG Electronics’ business, faced a significant challenge: a 50% tariff imposed by the U.S. government on steel derivative items. These tariffs drove up the cost of materials for refrigerators, washing machines, and air conditioners, especially in the United States—LG’s largest market. Coupled with weakened consumer sentiment due to price hikes, imports of home appliances to the U.S. saw a double-digit decline throughout the year.

Yet, LG Electronics didn’t sit idly by. The company responded by overhauling its operations—optimizing production bases, refining marketing tactics, and focusing on premium products. As LG Electronics explained in its earnings release, “The home appliance business continues to face tariff burdens on volumes exported to the United States and delayed recovery in global demand, but it is maintaining dominance in the premium market and delivering stable performance in the volume zone.” The company also highlighted the steady growth of its subscription business, which blends products and services for recurring revenue.

However, not all divisions shared in the stability. The Media Solutions (MS) division, which includes LG’s TV business, continued to struggle. Korean securities analysts estimate that the TV segment posted an operating loss of roughly 191.7 billion won in the second quarter and likely mirrored that result in the third. The reasons? Persistent sluggish demand in the global TV market and fierce competition from Chinese manufacturers offering low-priced LCD TVs. As Park Sang-hyun, an analyst at Korea Investment & Securities, put it, “The MS division is expected to remain in the red this quarter as well, due to increased marketing expense amid intensified competition with Chinese manufacturers, despite a slight drop in LCD panel prices.” Even with qualitative growth areas like WebOS seeing sales rise by up to 30% year-over-year, the gains weren’t enough to offset hardware losses.

But there’s a silver lining: LG Electronics’ next-generation growth engines are gaining traction. The vehicle component business, in particular, recorded record-high profitability in the third quarter, buoyed by expanded sales of premium in-vehicle infotainment systems and a diversification into content platforms for cars. The company stated, “Expanded sales of premium products in the in-vehicle infotainment business significantly contributed to profitability.” Additionally, the HVAC (heating, ventilation, and air conditioning) segment strengthened profitability by focusing on commercial air-conditioning systems and large-scale solutions for AI data center cooling—a rapidly growing market in North America, Central and South America, the Middle East, and Asia.

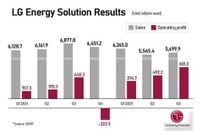

Meanwhile, LG Energy Solution (LGES)—the battery arm of the LG conglomerate and a key supplier to electric vehicle giants like General Motors and Tesla—navigated its own set of challenges and opportunities. According to Reuters and Aju Business Daily, LGES projected a third-quarter operating profit of 601.3 billion won (about $422.8 million), a 34% jump from a year earlier and well above analyst forecasts. However, sales during the same period fell 17.1% to 5.7 trillion won, reflecting a broader slowdown in global EV demand.

What drove the profit surge? Analysts and company executives point to a rush by U.S. consumers to purchase electric vehicles before the expiration of a $7,500 federal tax credit on September 30, 2025. This last-minute buying spree helped LGES beat market expectations, even as the company warned of a likely slowdown in EV demand heading into 2026 due to the loss of these incentives and persistent U.S. tariffs.

Yet, the profit picture was complicated by government support. Of the 601.3 billion won in operating profit, 365.5 billion won—or about 61%—came from U.S. subsidies under the Inflation Reduction Act. Stripping out these incentives, LGES still posted a net operating profit of 235.8 billion won, marking its second consecutive profitable quarter without subsidies. For the January–September period, operating profit was estimated at 1.46 trillion won, up a staggering 83.3% year-over-year, while sales fell 8.5% to 15.73 trillion won.

But it wasn’t all good news. In September, LGES faced a major setback when a large-scale immigration raid at its joint battery plant with Hyundai Motor in Georgia, U.S., led to the arrest of hundreds of South Korean workers. Construction at the site was suspended, with Hyundai Motor CEO Jose Munoz warning of a minimum two-to-three-month startup delay. LGES has since begun to gradually resume U.S. business trips for employees and subcontractors, following an agreement allowing South Koreans to work on equipment under existing temporary visas.

To counteract the looming EV market slowdown, LGES is ramping up production of batteries for energy storage systems (ESS)—a sector that’s gaining steam as utilities and tech companies seek alternatives to Chinese imports. The company recently inked a $4.3 billion deal to supply Tesla with ESS batteries, a move designed to diversify revenue streams and reduce reliance on the volatile EV sector.

Both LG Electronics and LG Energy Solution’s third-quarter stories are, in many ways, emblematic of the broader challenges facing global manufacturing giants in 2025. Trade policies, tariffs, shifting government incentives, and geopolitical disruptions can upend even the best-laid business plans. Still, the ability to adapt—whether by optimizing supply chains, focusing on premium markets, or diversifying into new growth areas—remains the defining trait of companies that endure.

As final third-quarter results are set to be released on October 30, industry watchers will be looking closely at how these Korean titans continue to navigate a landscape full of both risk and opportunity.