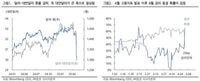

The Korean Won has seen a significant drop against the U.S. Dollar, starting at 1,380.0 won on May 7, 2025, following a decrease of 25.3 won from the previous trading day. This marks the lowest exchange rate in six months, as the currency dipped into the 1300 won range amidst a backdrop of intensifying trade negotiations between the United States and China.

The predicted weekly exchange rate for the Won against the Dollar is anticipated to be between 1,350 and 1,400 won, according to iM Securities. The firm noted that the offshore dollar had depreciated sharply during the recent holiday period, while the offshore won rose significantly. In the two business days from May 2 to May 5, the offshore dollar saw a nearly 9% rise, leading to a sharp decline in the dollar-won exchange rate, which fell by about 30 won to the 1,370 won level.

The backdrop for this depreciation includes a favorable first-quarter GDP growth rate, but the more significant factor appears to be U.S. pressure on Asian currencies related to ongoing trade negotiations with China. This pressure has led to rising expectations for currency agreements between the U.S. and Asian nations. The Won-Dollar exchange rate has now returned to levels not seen since before the state of emergency declared on December 3, 2024.

Despite the strong dollar, expectations of progress in trade negotiations, better-than-expected exports in April 2025, and the strengthening of other Asian currencies, including the Chinese Yuan and Taiwanese dollar, have all contributed to this shift. The dollar's strength has persisted even amid mutual tariff shocks, bolstered by favorable economic indicators such as the April 2025 employment figures.

The possibility of a rate cut by the U.S. Federal Reserve (Fed) in June 2025 has diminished significantly, adding to the dollar's strength. The probability of an interest rate freeze at the June FOMC meeting rose from 40% prior to the April employment report to over 60% afterward. Furthermore, the Dollar Index, which measures the dollar's value against six major currencies, fell by 0.33% to 99.463, reflecting the general weakening of the dollar.

In the Seoul foreign exchange market, the Won-Dollar exchange rate opened at 1,380.0 won, marking a 25.3 won drop from the previous day's closing price. This opening rate is the lowest since November 6, 2024, and is a significant milestone as it reflects the market conditions just before the election of Donald Trump as U.S. President became apparent.

As the exchange rate fell to the 1300 won range, analysts noted that it was the first time since the state of emergency declaration in December 2024 that the rate had dipped below this threshold. The recent fluctuations in the exchange rate are attributed to the effects of the Asian currency markets, which have been impacted by developments in the U.S.-China trade negotiations.

Reports indicate that the Taiwanese government has allowed its currency to appreciate as part of the trade negotiations with the U.S., leading to a significant rise in the value of the Taiwanese dollar. The dollar-Taiwan dollar exchange rate has reached its lowest point in three years amid expectations that the Taiwanese government will permit a stronger currency.

In the New York Non-Deliverable Forward (NDF) market, the one-month Won-Dollar rate closed at 1,374.00 won, indicating a drop into the mid-1300 won range. This decline is reportedly due to Taiwanese life insurance companies engaging in currency hedging, which has included the purchase of Won against the dollar.

Market analysts are also speculating on the potential for a renewed currency war, as the U.S. demands currency depreciation from its trading partners to address its trade deficit. This situation has led to a growing perception that a 'second Plaza Accord' could be on the horizon, where the U.S. pushes for currency adjustments among its trade partners.

Looking ahead, Lee Min-hyuk, a researcher at KB Kookmin Bank, noted that the ongoing depreciation of the dollar could lead to further declines in the exchange rate. However, he also suggested that bargain buying could support the lower end of the exchange rate. The Won-Yen cross rate was trading at 969.67 won per 100 yen, showing a slight increase from the previous day's rate.

As the situation develops, the Bank of Korea is monitoring exchange rate movements closely. Governor Lee Chang-yong commented during a recent press conference that the market expectations of U.S. discussions on exchange rates are significantly influencing current trends. He stated, "Even if there is no formal meeting like a 'second Plaza Accord,' the market expectation is greatly influencing the fact that there will be exchange rate discussions with the United States." He acknowledged the uncertainty surrounding what the U.S. will demand regarding exchange rates.

In summary, the Korean Won's sharp decline against the U.S. Dollar reflects a complex interplay of factors, including trade negotiations, currency pressures, and broader economic indicators. As the U.S. and China prepare for further discussions, the implications of these developments on the global currency landscape remain to be seen.