In a significant move for the semiconductor materials industry, JX Metals has made its debut on the Tokyo Stock Exchange Prime market on March 19, 2025. This listing represents a return to the public trading arena with one of the largest initial public offerings (IPOs) seen in Japan in nearly six years, since the SoftBank listing in 2018.

The total amount of shares being offered in this ambitious IPO is valued at around 439 billion yen, making it a highly anticipated event in the financial market. The public offering price was set at 820 yen per share, reflecting strong investor interest. Industry insiders have noted a significant demand from investors, with indications that requests were over three times the number of shares available to the public and nearly five times among overseas investors.

JX Metals, known for its substantial role in the semiconductor sector, manufactures sputtering targets—materials critical in the fabrication of semiconductors. The company currently holds over 60% of the global market share in sputtering targets. Clients range from industry giants like Taiwan Semiconductor Manufacturing Company (TSMC) and Intel to competitors including Honeywell International and Ningbo Jiangfeng Electronic Materials.

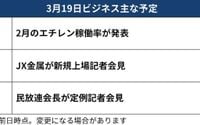

Yoichi Hayashi, the President of JX Metals, is expected to attend a press conference following the listing to discuss the company’s future strategies and how it plans to leverage the capital raised through this IPO for potential expansion and innovation in semiconductor production.

The hype surrounding JX Metals' IPO is further underscored by market reactions. Following the announcement of its IPO on February 14, 2025, the Nikkei Average Stock Price experienced a decline of 5% leading up to the determination of the offering price, which was adjusted down from the initial target of 862 yen to a finalized 820 yen. This adjustment reflects the caution among investors amid fluctuating market conditions, particularly influenced by geopolitical factors such as U.S. tariffs under the Trump administration.

Investment analysts are optimistic about this IPO. Toshiya Tomori, Executive Fund Manager at Mitsubishi UFJ Asset Management, commented that "investors likely deemed the IPO price reasonable." This perspective aligns with the overall sentiment toward the substantial demand noted during the pre-listing phase.

As JX Metals takes its position on the Tokyo Stock Exchange, attention will also be drawn to how this IPO could set a precedent for future offerings in the sector. As indicated by insiders, the successful listing of JX Metals is likely to influence other companies in the semiconductor industry preparing for their own IPOs. The discussion around JX Metals is not merely about its individual performance but also about its potential impact on investor sentiment in the marketplace.

The backdrop to this IPO underscores a larger narrative in Japan’s bustling financial landscape, where firms are increasingly integrating into global supply chains and attracting foreign investment. In these times, JX Metals stands at the forefront, merging innovation with significant market presence.

As the trading begins, the market watches closely. The anticipated opening of JX Metals' shares could pave the way for more IPOs, instilling a renewed confidence in the semiconductor sector from domestic and international investors alike.

In conclusion, JX Metals’ entry into the Tokyo Stock Exchange via this substantial IPO reflects broader trends in the market. Furthermore, it highlights the significant role the semiconductor industry plays in Japan's economy, carrying forward not just the company’s ambitions but also the expectations of investors looking for stability and growth in this vital sector.