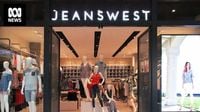

Jeanswest, the well-known Australian clothing retailer, has collapsed and is set to close more than 90 stores across the country, jeopardizing around 600 jobs as it enters voluntary administration. The announcement made on March 26, 2025, signifies another major blow to the retail landscape, which has already been challenged by shifting consumer behaviors and economic difficulties.

Harbour Guidance Pty Ltd, which oversees Jeanswest, appointed administrators Lindsay Bainbridge, Andrew Yeo, and David Vasudevan from Pitcher Partners Melbourne to manage the administration process. "The owners have done everything they can to keep Jeanswest going, but market conditions mean sustaining bricks-and-mortar stores is not viable and unlikely to improve," Bainbridge stated. This declaration underscores the mounting pressures on physical retailers amidst an ongoing cost-of-living crisis.

As part of the administration process, all stock at Jeanswest outlets will be put on sale immediately as the company pivots its focus towards online retail. "We will be opening the doors of all stores and selling online to clear all stock to secure a return to creditors," Bainbridge added. With this approach, Jeanswest hopes to leverage the substantial growth in online shopping, which saw Australians spend a record $69 billion last year—an increase of 12 percent from the previous year—largely driven by platforms such as Amazon and Shein.

The shift to online shopping has significantly impacted consumer habits, leading to less spending on non-essential attire and contributing to the mounting difficulties faced by mid-tier clothing brands. The recent calibre of competition and economic strain have intensified the pressures on businesses like Jeanswest, which competes with other local retailers such as Just Jeans and Jay Jays.

Interestingly, this current administration marks Jeanswest’s second crisis. The company previously faced financial trouble in early 2020 when it went into voluntary administration, resulting in the closure of 37 stores and the laying off of 263 staff members. Harbour Guidance, owned by Hong Kong textiles mogul Chun Fan Yeung, subsequently bought the brand out of administration and attempted to restore it within a highly competitive market.

In a statement reflecting on the latest wave of closures, Bainbridge expressed regret over the impact these decisions would have on employees and customers. "This is a hard day for hundreds of Jeanswest team members, and we will be working directly with the team members to provide clarity and information about the next steps," he noted. The sentiment highlights the human side of a crisis that involuntarily impacts the lives of employees, many of whom will face uncertain futures as the company trims its physical operations.

The environment surrounding Jeanswest's collapse fits into a larger narrative of a struggling retail sector. Following the demise of the Mosaic Brands portfolio, which included companies like Millers, Rivers, and Noni B that saw nearly 700 store closures and resulted in 2,800 job losses, the pattern of reduced physical presence is becoming more prevalent. The Mosaic collapse, which was driven by significant debt of over $318 million to creditors, further illustrates the vulnerability of retailers in today’s market.

Moving forward, the administrators will explore options to keep the brand alive primarily through online channels. This reflects a broader trend in retail where companies are increasingly forced to adapt to a landscape defined by e-commerce rather than traditional storefronts. The landscape has shifted, and it seems likely that more fashion retailers will follow suit as they navigate an economy where consumers are more conscious of their expenditures.

As other retailers look to adapt, the lessons from Jeanswest may resonate well beyond its remaining team members and loyal customer base, serving as a warning sign for companies still trying to maintain a physical retail presence. As consumer shopping behaviors continue to change, survival may very well depend on how decisively retailers can pivot from in-store sales to an online existence.