The Japanese housing market is undergoing significant transformations as increasing interest rates create ripples among homebuyers. Reports highlight the plight of individuals who, after making substantial investments in properties, find themselves navigating complications due to sudden relocation demands.

One notable case involves an individual who purchased a luxurious 'Tower Mansion' for 100 million yen. Unfortunately, a sudden job transfer compelled them to seek renters for the property. When renting becomes necessary, the looming pressure of remaining loan repayments makes the decision all the more daunting. Those caught in such financial webs often face calls for full repayment, which can be not only overwhelming but also untenable.

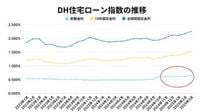

The backdrop to this situation is the shifting landscape of housing loan interest. In recent months, interest rates have been on an upward trend, driven by a combination of economic factors, including inflation and fiscal policy adjustments from the Bank of Japan. As of March 2025, the ongoing fluctuations see the DH Housing Loan Index's variable interest rate reaching 0.652%, up from 0.611% just a month earlier, and significantly higher than the 0.488% recorded one year prior.

Experts warn that the ongoing tweak to interest rates can complicate the purchasing power of potential buyers. Sensing the pressure from rising costs, many are hesitant to enter the market or engage in long-term financial commitments. This uncertainty has led to an uptick in average sales duration for used condominiums in Tokyo, with potential buyers increasingly wary of making hasty decisions.

In this precarious climate, various businesses, including popular food chains, are responding with discount campaigns aimed at enticing cost-conscious consumers. KFC, for instance, has launched a '30% OFF' promotion that begins on March 26, 2025, providing cherished comfort food at a markdown of 520 yen. With promotions like these, businesses aim to alleviate the economic strain faced by families.

Meanwhile, as banks react to economic shifts, they are continually adjusting their lending frameworks. Mizuho Bank, for instance, is expected to raise rates by 0.4%, a mixture of adjustments from the past and present pushing towards a tighter financial landscape. These changes come amidst predictions that variable interest rates may reach between 1-1.3% by year-end, pointing to an increasingly challenging environment for borrowers.

Moreover, the early part of March 2025 has been marked by speculation surrounding the rise of interest rates related to changes in U.S. fiscal policy under the Trump administration. The current dollar-yen pairings hanging in the 140-yen range amplify concerns over both domestic and international economic stability, leading many consumers to scrutinize every move in the housing market.

On the regulatory side, Tokyo's housing policies are also being examined closely, as legislators contemplate frameworks that could ease financial burdens while promoting sustainable growth in the housing sector. The timeline for potential regulations remains uncertain, but stakeholders remain hopeful for changes aimed at stabilizing the market.

Alongside the economic complexities, minor traffic and delivery issues are surfacing as parking laws impose additional financial burdens on workers. Delivery drivers, for example, have reported accruing fines despite their reliance on designated 'free parking' areas, raising concerns about workplace inequities and urging calls for regulatory reforms.

As the landscape morphs, personal stories continue to emerge, revealing challenges faced by individuals striving for stability amidst ongoing change. An 82-year-old mother recently decided to enter a nursing home after becoming concerned about relying on her son, who earns a modest 10万円 per month. This heartfelt narrative underscores the human aspect that often gets lost in larger economic discussions.

Amid this backdrop, the real estate market remains on the radar as more companies assess investments and strategies to navigate a potentially bumpy financial road ahead. For many, these changes evoke not only concerns but also aspirations about the future of housing in Japan. Understanding the trends can be crucial for making informed decisions within a market that is anything but predictable.

In closing, the current trajectory suggests that ongoing consultations among industry leaders, coupled with consumer adaptability to evolving economic landscapes, will play a central role in shaping Japan's housing market in 2025 and beyond. As regulations, interest rates, and consumer behaviors fluctuate, potential and existing homeowners alike must remain vigilant to safeguard their financial investments amidst these swirling changes, further emphasizing the importance of awareness and preparedness in navigating complex market dynamics.