Japan's tourism industry is experiencing a robust revival, marked by a 16.9% increase in the number of foreign visitors in February 2025 compared to the previous year, reaching approximately 3.26 million. As reported by the Japan National Tourism Organization (JNTO), this surge is driven by high demand for recreational activities and the conclusion of the Chinese New Year celebrations.

The influx of tourists is notable as it is the first time in February that the number surpassed three million. Particularly strong increases were noted among travelers from Australia and the United States, with Australian visitors jumping by 53.5% to 88,800, while U.S. tourist numbers rose by 28.8% to 191,500.

In addition to the high profile tourism figures, Japan has set a positive precedent with annual tourist figures, achieving a record of 36.8 million foreign visitors in 2024, significantly exceeding pre-pandemic levels. However, major tourist destinations, particularly Mount Fuji, have seen a reduction in visitors compared to previous years due to new measures aimed at managing over-tourism. Just 178,000 tourists visited the iconic mountain in February 2025, down from 205,000 in 2024.

As the country continues to benefit from the tourism boom, it is concurrently facing challenges in its trade sector. The latest statistics revealed a 11.4% increase in exports in February 2025, correlating closely with companies ramping up orders before new tariffs introduced by the U.S. come into play. Despite the increase being below expectations of 12.6%, it nonetheless signals elevated export activity as Japan pushes to maintain economic momentum.

The Japanese Ministry of Finance announced that imports saw a minor rise of 0.7%, falling short of anticipated increases. This fluctuation has resulted in a trade surplus of 584.5 billion yen (approximately $3.9 billion), contributing positively to Japan's economic growth during the latter part of 2024.

Regionally, the statistics reflect a nuanced pattern; exports to the United States saw a value increase of 10.5%, although volume dropped by 3.3%. Contrastingly, exports to China surged with a 14.1% rise, likely benefiting from increased demand around the Chinese New Year. However, a noted decline in exports to Europe by 7.7% raises questions about potential future shifts in trade relationships.

Complications loom due to the ongoing stance of U.S. President Trump regarding tariffs, particularly as firms brace for additional duties on cars and steel set to be implemented soon. Economic analyst Yoichi Kodama mentions that while part of the surge can be attributed to increased orders before tariff hikes, growth in volume remains sluggish, raising uncertainty about sustainability.

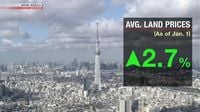

Meanwhile, Japan's land market is seeing its own revitalization, with average prices increasing for four consecutive years, driven in large part by the boom in the tourism sector and construction of semiconductor factories. The Ministry of Land, Infrastructure, Transport, and Tourism reported a 2.7% overall rise in land prices as of January 1, 2025.

Particular hotspots like Forano in Hokkaido have witnessed astonishing price jumps, soaring by 31.3%, while the neighboring Hakuba area of Nagano Prefecture also reported significant increases of 29.6%. Both locations are anticipated to become favorites among tourists, which further emphasizes the growing demand for vacation homes and second residences.

Commercial land is not lagging either; it has risen 3.9%, hinting at an ongoing demand driven by projected tourist influxes and a shift towards developing apartments, offices, and hotels. An area in Chitose City stands out with a staggering 48.8% increase in land prices, aligning with plans to establish a new semiconductor manufacturing facility by Japanese company Rapidus.

As Japan navigates these dual realms of burgeoning tourism and burgeoning export activity amidst the complexities brought on by U.S. trade policies, it remains to be seen how these factors will interact and influence the nation’s overall economic landscape moving forward. Despite uncertainties on the global trade stage, Japan's ability to draw international tourists and bolster its industrial exports presents an optimistic outlook.