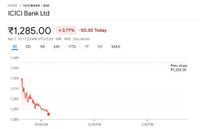

Shares of ICICI Bank Ltd, one of India’s leading private sector lenders, witnessed a significant sell-off during early trading hours on the National Stock Exchange (NSE) today, April 7th. The bank’s stock price tumbled sharply shortly after the market opened. As recorded at 10:17 AM IST, ICICI Bank shares (ticker: ICICIBANK) were trading markedly lower at ₹1,285.00. This reflects a substantial intraday decline of 3.77%, translating to a fall of ₹50.30 per share from its previous closing price of ₹1,335.30 on the NSE.

The 1-day trading chart clearly shows a steep downward trajectory for the ICICI Bank share price right from the start of the session, indicating strong selling pressure on the counter. This drop below the ₹1,300 mark represents a notable negative move for the heavily-weighted banking stock. ICICI Bank is a major constituent of benchmark indices, and its performance is closely tracked by investors monitoring the Indian stock market and the financial services sector.

The significant early decline has captured market attention, with participants now observing the stock’s movement for the remainder of the trading day. Other banks also experienced notable declines; for instance, Canara Bank shares fell by 5.02% to ₹86.07, while Axis Bank shares dropped 5.07% to ₹1,038.65. These declines reflect a broader trend affecting the banking sector today.

The NIFTY BANK index, which includes several prominent banks, is currently trading at 49,263.95, down by a significant 4.35 percent, equivalent to 2,238.75 points, during today's trading session. The index opened at 49,336.10, marking a considerable downturn from its high of 50,426.25, while briefly touching a low of 49,242.25. Investors are closely monitoring the NIFTY BANK index amidst this volatility in today's session.

The NIFTY BANK index has demonstrated varying returns across different time frames. The index has a year-to-date (YTD) return of -3.08 percent. Over the past month, the NIFTY BANK index has seen a gain of 1.64 percent, but has fallen by 4.41 percent over the last week. Looking at longer periods, the NIFTY BANK index has increased by 1.65 percent over the past year and 20.11 percent over the past two years. Over the past three years, the NIFTY BANK index has shown a return of 31.25 percent.

Technical indicators for the NIFTY BANK index show the following: The simple moving average (SMA) for 50 days is 49,516.92, and the SMA for 200 days is 51,027.89. The relative strength index (RSI) is at 45.93, indicating a neutral market condition. The moving average convergence divergence (MACD) stands at 537.71, while the stochastic oscillator is at 45.56. The rate of change (ROC) is 2.18, the commodity channel index (CCI) is -13.66, and the average directional index (ADX) is 27.99, suggesting a potential downtrend in the banking sector.

As the trading day progresses, the market sentiment remains cautious. The broader Indian market opened with significant declines: the Sensex is down 5.19% at 71,449.94 points, and the Nifty 50 is down 5.00% at 21,758.40 points. GIFT Nifty is trading at 22,115.50, down 843.50 points (-3.67%). SENSEX closed at 75,364.69, down 930.67 points (-1.22%), and NIFTY 50 closed at 22,904.45, down 345.65 points (-1.49%). GIFT Nifty is trading at 22,132.00, down 827 points (-3.60%).

Several stocks on the Nifty 500 experienced price declines, reflecting the overall market downturn. Stocks such as Tata Technologies, which fell 5.89% to ₹612.60, and TVS Motor Company, down 5.25% to ₹2,342.10, are indicative of the widespread bearish trend. Other notable declines include SRF, United Breweries, and Voltas, each experiencing significant losses.

Market analysts suggest that the current volatility may be a reaction to various economic factors affecting investor sentiment. With the banking sector under pressure, experts are advising investors to remain cautious and closely monitor market developments. The fluctuations in stock prices are often influenced by broader economic indicators, regulatory changes, and shifts in investor confidence.

In summary, ICICI Bank's sharp decline today is part of a larger trend affecting the banking sector in India. As investors navigate through this turbulent market, the performance of banks like ICICI will continue to be a focal point for market watchers. The coming days will be crucial in determining whether this downturn is a temporary blip or indicative of deeper issues within the financial sector.