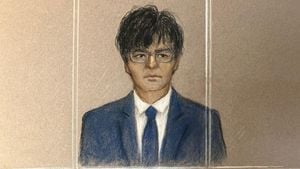

On January 29, 2025, Takeya Sakamoto, the president of Hokkaido-based YS Foods, along with two of his associates, faced criminal charges for allegations of insider trading and related activities. The Securities and Exchange Surveillance Commission (SESC) filed this complaint to the Sapporo District Public Prosecutors Office, as reported.

The allegations center on Sakamoto's actions back in 2023 when he allegedly engaged in the purchase of shares from Yoshimura Food Holdings, anticipated to acquire YS Foods. Utilizing confidential information about this acquisition, he is accused of making improper trades worth approximately 16.22 million yen.

Things took another turn as the investigation expanded to include Sakamoto's acquaintances, with reports indicating he shared insider information with three individuals. Such exchanges, if proven true, could significantly amplify the legal pressures on both Sakamoto and those who received the tips.

It doesn't stop at Sakamoto. On the same day, the president of another subsidiary of Yoshimura Food Holdings, also involved with different fish processing operations located in Abashiri City, faced similar charges for illegally purchasing shares worth around 70 million yen.

This recent push from the SESC signifies stringent efforts to address corporate misconduct in Japan's fish processing sector, particularly following numerous scandals the industry has faced. The actions of Sakamoto and his peers have sparked greater discussions on regulatory oversight—will more stringent measures be enforced to prevent insider trading, and what might this mean for fish processing companies at large?

Both Sakamoto and the other accused parties are expected to respond to the allegations as the investigation progresses. The ramifications of their actions could reverberate throughout their companies, impacting not only their reputation but also possibly leading to financial penalties or jail time if convicted.

While the legal proceedings are just beginning, they shine light on the precarious balance businesses must maintain between competitive strategy and legal compliance. Insider trading undermines trust and could deter investments and partnerships, which are pivotal for companies aiming to thrive.

Industry experts are watching closely as these allegations develop, particularly within the troubled sector of fish processing. The public and regulators alike will be demanding answers on what appears to be egregious misconduct, and the coming months will likely yield more revelations.

The fish processing sector, already contending with operational challenges, may find its credibility severely impacted if Sakamoto and others are found guilty. This situation serves as both a cautionary tale and clarion call for stronger governance practices across all levels of industry.

The case builds on the commitment of Japanese regulators to clamp down on insider trading and maintain ethical business practices, which are increasingly necessary to preserve investor confidence and the integrity of financial markets. Observers express caution, insisting such measures must translate from talk to action effectively.