HLB Group shares plummeted dramatically on March 21, 2025, following the announcement that its liver cancer drug, 'Livoceranib', was again denied approval by the U.S. Food and Drug Administration (FDA). This rejection sent ripples through the company's stock prices, resulting in steep declines for both HLB Group and its subsidiaries.

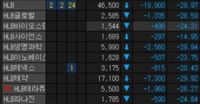

As of 9:30 AM on the day of the announcement, HLB’s shares had dropped by 28.77%, trading at 47,300 won. Other affiliated companies, including HLB Life Science and HLB Pharmaceutical, similarly saw significant valuation drops, underscoring the broader market impact of the FDA's decision.

According to reports, the FDA issued a Complete Response Letter (CRL) regarding 'Livoceranib'—a drug that had been positioned to become the second Korean anticancer treatment to receive FDA approval, following Yuhan Corporation’s lung cancer drug, 'Leclaza', which gained FDA nod in August 2024.

In a YouTube announcement, Jin Yang-gon, Chairman of HLB Group, clarified that the latest CRL was focused on unresolved Chemistry, Manufacturing, and Controls (CMC) issues pertaining to the combination of 'Livoceranib' and the immunotherapy 'Camrelizumab'. This was compounded by a previous CRL received in May 2024, which had already delayed the approval process.

Jin expressed deep disappointment over the situation, stating, "I believed I could bring good news to shareholders, but I am disappointed to relay this news again." He emphasized the need for further dialogue with the FDA to understand the specific deficiencies raised and to outline how the company plans to address them.

HLB's expectations for approval were high, considering the urgency and optimism surrounding its liver cancer drug. Experts had believed that the issues cited in the initial CRL were minor and easily rectifiable. However, the ongoing setbacks have left many investors uncertain about the future.

As market reactions unfolded, the numbers painted a concerning picture—HLB stock dropped to 47,800 won, a staggering decrease of 28.01% earlier in the day. Other subsidiaries also suffered, with HLB Pharmaceutical’s shares falling by about 23.98% and HLB Life Science plummeting 25.73%.

With the second CRL now in hand, HLB announced plans to quickly engage with the FDA to clarify the required amendments. Jin noted that the transparency surrounding the CRL would be maintained, stating, "We plan to submit the CRL to the Korea Exchange to ensure transparency, even though there are challenges related to disclosing specifics due to interactions with the pharmaceutical company."

This turbulent episode highlights the fragile nature of pharmaceutical stocks, particularly those linked to new drug approvals and regulatory challenges. Shareholders are closely monitoring the situation, with hopes that HLB can swiftly address the FDA's concerns and ultimately secure the coveted approval.

Jin's commitment to resolve the regulatory hurdles remains steadfast. "We have worked tirelessly for the past ten months, and we will overcome this setback and persevere," he reassured. As HLB maneuvers through this challenging landscape, the market's response will continue to evolve, driven by developments in the approval process.

As it stands, concerns around HLB’s future growth trajectory are warranted, especially with ongoing compliance issues and the unpredictable regulatory environment contributing to unease among investors.

![[특징주] HLB, 신약 美 FDA 승인 또 불발... 주가 하한가로 급락](https://thumbor.evrimagaci.org/0JG8TTd1c3I4fDuw6HlGbEioyzs=/200x0/tpg%2Fsources%2Fd1bc9229-bc06-4a36-9dec-2d4db9298005.jpeg)