Hanwha Solutions is experiencing a significant surge in its stock price following a remarkable turnaround in its first-quarter financial performance. As of 9:40 AM on April 25, 2025, the company's shares were trading at 33,000 won, reflecting an impressive increase of 11.81% from the previous trading day. This follows an earlier rise of 11.27% the day before, highlighting growing investor confidence in the company.

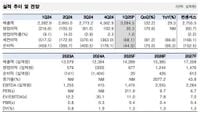

On April 24, Hanwha Solutions reported that it achieved consolidated sales of 3.0945 trillion won and an operating profit of 30.3 billion won for the first quarter of the year. This marks a substantial 31.49% increase in sales compared to the same period last year. Furthermore, the operating profit represents a significant turnaround from the operating loss of 216.6 billion won reported in the first quarter of the previous year.

The company’s new and renewable energy segment played a pivotal role in this positive shift, recording sales of 1.5992 trillion won and an operating profit of 136.2 billion won. This improvement is largely attributed to enhanced profitability in the U.S. residential energy market, which has shown promising recovery.

Investment firms have taken notice of Hanwha Solutions' strong performance. IBK Investment & Securities raised its target stock price for the company from 32,000 won to 37,000 won on April 25, citing that the operating profit significantly exceeded market expectations, which had predicted an operating loss of 60.7 billion won. Researcher Lee Dong-wook noted that the improvement in the new and renewable energy division was a key factor in this unexpected success, despite ongoing losses in the chemical and advanced materials divisions.

Hana Securities echoed this sentiment, also raising its investment opinion on Hanwha Solutions from 'Neutral' to 'Buy' and increasing its target price from 23,000 won to 34,000 won. Researcher Yoon Jae-sung highlighted that the company had already observed a slight increase in module prices as of the first quarter, indicating potential for further performance improvements.

Analysts from Korea Investment & Securities noted that the turnaround in the new and renewable energy business presents a high potential for re-evaluation of the company’s market value. Researcher Hwang Hyun-jung stated that Hanwha Solutions' first-quarter operating profit of 30.3 billion won exceeded market expectations, which had predicted continued losses for two consecutive quarters. While the solar module division and the chemical business continued to face challenges, the residential energy sector saw a remarkable improvement in profitability, with a gain of over 100 billion won compared to the previous quarter.

In particular, the new and renewable energy division recorded an impressive operating profit of 136.2 billion won, a 125% increase from the previous quarter. The residential energy division alone contributed 129.2 billion won in operating profit, achieving an operating profit margin of 22%. This success was bolstered by the recovery in demand for residential solar installations in the U.S., particularly benefiting from the Third Party Ownership (TPO) business model that was fully established last year.

Despite the challenges faced by the solar module division, which remains in the red, analysts expect profitability to recover as excess inventory gradually decreases. The chemical division reported operating losses of 91.2 billion won, which have increased by 37 billion won compared to the previous quarter due to regular maintenance impacts amid a slow market recovery.

Looking ahead, analysts anticipate that profitability will gradually rebound starting from the second quarter, as the effects of one-off factors diminish and improvements in key product spreads are expected, particularly in light of economic stimulus measures in China. While the company has been focused on achieving a turnaround in its module business, Hanwha Solutions has successfully diversified its revenue streams through a comprehensive value chain expansion that encompasses production, installation, and finance.

The current economic climate remains cautious due to uncertainties stemming from U.S. trade disputes. However, Hanwha Solutions' domestic production base is becoming increasingly robust, positioning the company well for future growth. As the renewable energy sector continues to evolve, the company’s strategic moves to enhance its market presence and operational efficiency will be closely watched by investors and analysts alike.

In summary, Hanwha Solutions' recent financial results signal a promising recovery and highlight the growing importance of its renewable energy initiatives. With a strong operational performance and positive market sentiment, the company is poised for further advancements in the coming quarters.