Gold prices in the United Arab Emirates (UAE) saw a notable increase on April 22, 2025, reflecting a growing trend in the global gold market. The price for gold per gram reached 411.09 United Arab Emirates Dirhams (AED), a rise from AED 404.39 the previous day. Additionally, the price for gold per tola surged to AED 4,794.85 from AED 4,716.69 on April 21, 2025, according to data compiled by FXStreet.

This surge in gold prices comes amid ongoing economic uncertainty, particularly linked to geopolitical tensions and fluctuating trade policies. The price of gold is often seen as a safe-haven asset, attracting investors looking for stability during turbulent times. The current economic climate, marked by concerns over tariffs and their potential impact on global markets, has further fueled this demand.

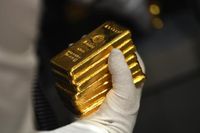

In the UAE, gold plays a crucial role in the economy, with the nation establishing itself as a significant player in the global gold trade. More than a third of the UAE's imports consist of gold reserves, underscoring the metal's importance in the region. Primary markets for gold in the UAE include India, Switzerland, and the USA, with gold imports reaching a staggering $20 billion in 2019. This figure highlights the UAE's growing prominence as a gold trading hub.

The dynamics of supply and demand in the UAE's gold market are primarily driven by consumer purchases of jewelry, which account for nearly half of all gold transactions. Institutional investors and banks also play a pivotal role, often acquiring large quantities of gold during periods of economic uncertainty or when profit potential appears favorable. Despite the UAE having some domestic production, it heavily relies on global markets to meet its gold supply requirements, with imports primarily coming from Africa and Europe.

Looking ahead, the UAE's gold market is expected to navigate various geopolitical and economic factors that may influence its trajectory. Fluctuations in oil prices and concerns regarding global economic growth could impact the demand for gold products. Furthermore, the ongoing transition from physical gold to digital investments may present challenges to the UAE's position as a leading trading hub for precious metals. Nevertheless, the nation’s robust infrastructure, supportive government policies, and active engagement in international initiatives signal a promising outlook for its continued dominance in the industry.

Understanding the purity of gold is essential for consumers. Gold is measured in carats or karats, with pure gold denoted as 24K. However, pure gold is too soft for jewelry, so it is typically alloyed with other metals to enhance durability. Here’s a breakdown of common gold alloys:

- 24K: Pure gold.

- 22K: Contains 91.7% gold.

- 21K: Contains 87.5% gold.

- 18K: Contains 75% gold.

- 14K: Contains 58.3% gold.

- 9K: Contains 37.5% gold.

The recent rise in gold prices is not only a reflection of local market dynamics but also influenced by international trends. The uncertainty surrounding U.S. President Donald Trump's trade policies, particularly his steep tariffs, has kept investors on edge. Recent statements from Trump regarding Federal Reserve Chair Jerome Powell, accusing him of not acting quickly enough to lower interest rates, have also contributed to the volatility in the market. Trump and his team are reportedly considering whether they can remove Powell before the end of his term, raising concerns about the independence of the Federal Reserve’s monetary policy.

According to the CME Group's FedWatch Tool, traders are pricing in the possibility of the Federal Reserve cutting interest rates by 25 basis points in June 2025, with expectations of at least three rate reductions throughout the year. This potential shift in monetary policy may impact the U.S. dollar, which typically has an inverse relationship with gold prices. A weaker dollar generally leads to higher gold prices, as the metal becomes more affordable for holders of other currencies.

On the geopolitical front, tensions remain high as Russian forces launched 96 drones and three missiles into eastern and southern Ukraine following a short-lived ceasefire. Such geopolitical instability often drives investors toward gold as a safe-haven asset, further supporting its price.

Gold has historically served as a store of value and medium of exchange, and its significance has only grown in recent years. In 2022, central banks added 1,136 tonnes of gold worth around $70 billion to their reserves, marking the highest annual purchase since records began. Emerging economies, particularly China, India, and Turkey, are rapidly increasing their gold reserves, further solidifying gold's status as a critical asset in times of economic uncertainty.

As the global landscape continues to evolve, the gold market in the UAE is likely to remain a focal point for investors. With its rich history and cultural significance, gold is not just a commodity but also a symbol of wealth and stability. The interplay of local and international factors will be crucial in shaping the future of gold prices in the UAE and beyond.

In summary, the recent rise in gold prices in the UAE reflects broader economic uncertainties and geopolitical tensions, underscoring the metal's enduring appeal as a safe-haven asset. As the market navigates these challenges, the UAE's position as a leading gold trading hub appears secure, bolstered by strong demand and a robust import infrastructure.