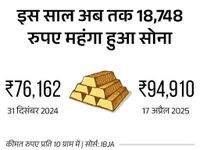

On April 18, 2025, gold prices soared to record levels across India, with rates exceeding ₹97,700 in most states. The surge in gold prices is primarily attributed to escalating tariff tensions between the United States and China, which have unsettled global markets and driven investors toward safe-haven assets like gold and silver.

In Delhi, the price for 22-carat gold was set at ₹89,600 per 10 grams, while 24-carat gold was priced at ₹97,600. Similarly, in Mumbai, 22-carat gold was available for ₹89,450, and 24-carat gold for ₹97,580. Other major cities reported comparable rates, with Chennai's 22-carat gold priced at ₹89,450 and 24-carat gold at ₹97,580.

Across the country, silver prices also saw a notable increase, reaching ₹99,900 per kilogram on the same day. This represents a ₹100 rise compared to the previous day, April 17, 2025, when silver was priced at ₹99,800.

The surge in gold prices is also reflective of the ongoing wedding season in India, which traditionally boosts demand for gold jewelry. In Ranchi, for instance, the price for 22-carat gold rose to ₹91,000 per 10 grams, marking a significant increase from ₹89,950 just the day before. The price for 24-carat gold in Ranchi reached ₹95,550 per 10 grams, further emphasizing the upward trend.

Market analysts suggest that gold prices could stabilize around ₹75,000 per 10 grams if current market conditions remain steady. However, should the tariff dispute between the U.S. and China escalate, predictions indicate that gold prices could spike to as high as ₹1,38,000 per 10 grams.

In Bokaro, the rates for 22-carat gold were recorded at ₹90,600 and ₹95,400 for 24-carat gold per 10 grams. Jamshedpur reported prices of ₹89,600 for 22-carat gold and ₹97,400 for 24-carat gold. Meanwhile, Deoghar's prices were similar to Ranchi, with 22-carat gold priced at ₹91,000 and 24-carat gold at ₹95,500.

As for silver, it remained stable in Ranchi at ₹1,10,000 per kilogram, the same price as the previous day. The Ranchi Jewellery Association noted that while gold prices are experiencing volatility, silver prices have remained constant.

Experts have pointed out several factors contributing to the rising gold prices. The ongoing trade war between the U.S. and China has created uncertainty in the market, prompting investors to seek refuge in gold as a secure investment. Additionally, the depreciation of the Indian rupee against the dollar has made gold imports more expensive, further driving up domestic prices.

The wedding season, which typically sees a spike in gold demand, is also playing a critical role in the current market dynamics. Jewelers report that despite the high prices, consumer interest in gold jewelry remains strong, as it is viewed as a symbol of prosperity and investment.

In the past week alone, gold prices have increased by over ₹1,000, with the price of 24-carat gold opening at ₹95,410 on April 18, 2025. This is a significant jump from ₹94,010 just a week prior, indicating a robust demand for gold amidst market uncertainties.

The All India Jeweler and Gold Smith Federation has also highlighted that investments in gold ETFs have surged, with approximately 60 tons invested in the first quarter of the current financial year. This trend is expected to continue, especially as the festive season approaches, with predictions indicating that gold prices could reach ₹1 lakh by Diwali.

In summary, the current climate of global economic uncertainty, combined with seasonal demand, is driving gold prices to unprecedented heights. As consumers prepare for weddings and festive purchases, the market remains dynamic, with both gold and silver prices likely to continue fluctuating in response to global events.

For those considering gold purchases, it is essential to ensure that the gold is hallmarked, as this guarantees its quality and authenticity. The Bureau of Indian Standards (BIS) is responsible for certifying the hallmarking of gold, ensuring consumers receive genuine products.

With the ongoing geopolitical tensions and the upcoming wedding season, it is advisable for investors and consumers alike to keep a close eye on gold prices and consider incorporating gold into their portfolios as a secure investment option.