The global stock markets are experiencing significant turmoil following the recent announcement of new tariffs by U.S. President Donald Trump, which has raised fears of an impending trade war. The DAX, Germany's leading stock index, plummeted by more than 5 percent, losing over 1,000 points and reaching a preliminary daily low of 20,590 points. This sharp decline comes as the index is now nearly 12 percent away from its record high achieved just mid-March.

As the trading day progressed, the DAX initially lost 0.80 percent, opening at 21,543.47 points, but soon fell below the critical 21,000 mark. The index's decline reflects widespread investor anxiety about the potential repercussions of Trump's tariff policies on global economic stability. "The fear of a global recession due to the new U.S. tariffs is driving the markets down," said market expert Robert Rethfeld, emphasizing that this new reality is yet to be fully absorbed by investors.

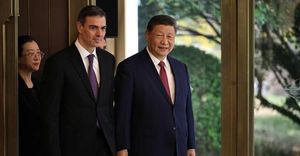

China has responded to the U.S. tariffs by imposing retaliatory measures, including a staggering 34 percent tariff on American goods, effective April 10, 2025. This move has further exacerbated fears of a trade conflict that could destabilize international markets. The Chinese government has also placed eleven American companies on a blacklist and introduced export controls on several rare earth materials, signaling a robust response to U.S. actions.

In the aftermath of these developments, stocks across various sectors have been hit hard. Deutsche Bank's shares plummeted by over 10 percent, while Commerzbank's stock fell by more than 7 percent. The automotive sector was not spared either, with Volkswagen's shares dropping over 5 percent, BMW nearly 5 percent, and Mercedes experiencing a loss of more than 6 percent.

Internationally, the situation is equally grim. The Japanese Nikkei index fell by 2.8 percent, while the U.S. markets saw the Dow Jones drop by 4 percent and the S&P 500 decline by 4.8 percent, marking the largest single-day losses since the onset of the COVID-19 pandemic. The tech-heavy Nasdaq index suffered an even steeper decline of 6 percent.

Despite the bleak market conditions, there was a silver lining in the latest U.S. job growth report, which indicated the creation of 228,000 new jobs in March, surpassing economists' expectations of 140,000. However, this positive news was overshadowed by downward revisions of previous months' job growth figures, which saw a combined loss of 48,000 jobs.

U.S. Chief Strategist Lori Calvasina from RBC noted a growing sense of fear regarding economic growth, reminiscent of previous downturns in 2010, 2011, and 2018. She has revised her year-end target for the S&P 500 down to 5,550 points, indicating a lack of confidence in a quick market recovery.

Trump's tariff policy has drawn sharp criticism from various political leaders and economists. Anna Cavazzini, a member of the European Parliament, described Trump's actions as "economic suicide," suggesting that the U.S. risks entering a severe economic crisis due to these tariffs. Similarly, Katarina Barley, another EU politician, emphasized the need for a strong response, including possible retaliatory tariffs and taxation of digital services.

Meanwhile, the World Trade Organization (WTO) has expressed deep concern over the potential impact of the U.S. tariffs, predicting a decrease in global merchandise trade volume by about 1 percent this year. WTO Director-General Ngozi Okonjo-Iweala highlighted the dangers of escalating trade tensions, warning that retaliatory measures could lead to further declines in trade.

In Canada, the government has already instituted a 25 percent import fee on vehicles manufactured outside the North American trade pact, USMCA, as a countermeasure against U.S. tariffs. Prime Minister Mark Carney stated that Canada must defend its interests and sovereignty in light of the current trade climate.

As investors seek refuge from the stock market turmoil, commodities like gold have seen a surge in demand, reaching record highs. Gold prices have been climbing, hitting a peak of $3,167.74 per ounce before settling at $3,108, reflecting a traditional flight to safety during market crises.

With the weekend approaching, market participants are anxious about the potential for further developments in the U.S.-China trade relationship. The upcoming speeches by Federal Reserve officials, including Chairman Jerome Powell, are being closely watched for insights into the future monetary policy direction amid rising inflation concerns linked to the tariff situation.

As the situation continues to evolve, the global financial landscape remains precarious, with many investors bracing for what could be a prolonged period of volatility and uncertainty in the markets. The fear of a global recession looms large, and the implications of Trump's tariffs will likely be felt across various sectors for the foreseeable future.