In a remarkable surge of interest, global searches for "stablecoin" hit an all-time high in July 2025, coinciding closely with the signing of the United States' landmark GENIUS Act on July 18. This legislation, officially titled the Guidance and Empowerment for National Innovation in US Stablecoins Act, represents a pivotal moment in the regulation and adoption of stablecoins within the American financial system.

Stablecoins, a form of cryptocurrency designed to maintain a stable value by pegging to traditional assets like the US dollar, have long operated in a regulatory gray area. The GENIUS Act aims to clear this ambiguity by establishing a clear legal framework for stablecoin issuance and use, thereby fostering safer integration into payments and digital finance ecosystems. The law mandates that only licensed entities may issue stablecoins in the US, with the requirement that these digital assets be 100% backed by secure reserves such as cash or short-term US government bonds. Additionally, issuers must provide daily proof of reserves, ensuring transparency and safeguarding users’ trust.

The timing of the surge in search interest is telling. Data from Google Trends show that the term "stablecoin" steadily climbed in popularity in the weeks leading up to the legislation’s passage, peaking just days before President Donald Trump signed the bill into law. Following the enactment, search interest remained robust, with a relative index score of 75 out of 100 globally, indicating sustained public and institutional curiosity.

Geographically, the highest local interest in stablecoins was recorded in Washington D.C., the nation’s capital, followed by nearby Hyattsville and Arlington. This pattern suggests that lawmakers and regulators’ focus on the subject may have spurred heightened attention in these regions, reflecting the close connection between legislative activity and public engagement.

In contrast, the European Union’s regulatory approach, notably through the Markets in Crypto-Assets (MiCA) regulation that came into force on June 30, 2024, has produced a more muted impact on search trends. The EU’s framework, which also governs stablecoin issuance and use, has maintained a relatively stable global search interest at around 11.7 points, a stark difference from the nearly 16% jump in US interest following the GENIUS Act. This disparity highlights the unique momentum generated by the US regulatory breakthrough.

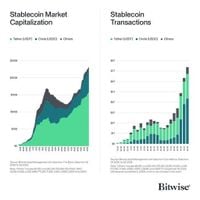

The stablecoin market itself is booming alongside this surge in attention. According to CoinGecko, the total market capitalization of stablecoins has reached $272 billion, accounting for about 7% of the entire cryptocurrency market. Bitwise, a notable asset management firm, described this growth as "parabolic," with both market capitalization and trading volumes hitting record highs. Approximately 98% of stablecoins are pegged to the US dollar, with Tether (USDT) dominating the market with a 60% share.

Despite the regulatory progress, interest in specific stablecoin tokens reveals regional preferences. USDT continues to lead globally with a search interest index of 55, far outpacing USDC’s 8. This 6.9-to-1 ratio surpasses their market capitalization gap, as USDT circulates around $163 billion compared to USDC’s $63 billion. USDC, however, commands stronger interest in developed Western markets, including cities like New Orleans, Portland, Seattle, Boston, and San Francisco. Conversely, USDT holds sway in emerging markets such as Lagos, Nigeria, Phnom Penh in Cambodia, Taipei’s Da’an District, Singapore, Lisbon, and San Jose, California. This East-West divide reflects differing infrastructure, liquidity, and adoption dynamics across global regions.

Experts and industry leaders underscore stablecoins’ growing importance as a financial bridge and risk mitigator. Nassar Al Achkar, strategy director at CoinW exchange, described stablecoins as a "shield" against the notorious volatility of the broader crypto market. Their stability and ease of use make them invaluable for cross-border payments and as safe havens during periods of economic uncertainty.

Institutional interest is rising as well. Major banks such as JPMorgan Chase and Citigroup are reportedly exploring plans to issue their own stablecoins, signaling a shift toward mainstream acceptance. Financial technology companies and traditional financial institutions alike have lobbied for legal clarity, which the GENIUS Act now provides, enabling them to confidently participate in this expanding space.

The legislation also facilitates the legal use of stablecoins in decentralized finance (DeFi) and asset tokenization, where real-world assets like real estate, stocks, or art are converted into digital tokens on blockchain platforms. This development paves the way for innovative financial products and services that blend traditional and digital finance.

Social media and crypto analysts have taken note of the momentous shift. The DeFi Investor, a prominent crypto commentator, tweeted, "The searches for stablecoins are surging. People are waking up to their potential. Stablecoins are the product that can onboard the first billion people on-chain." This sentiment captures the transformative promise stablecoins hold for expanding blockchain adoption to a global scale.

However, not all perspectives are without caution. Some US senators have expressed concerns over the privacy implications of certain stablecoin projects, particularly those linked to large technology companies like Meta. These worries center on potential risks to consumer data privacy and the broader regulatory oversight required to protect users.

Despite these concerns, the stablecoin landscape is evolving rapidly. Companies like Visa and Ripple are investigating stablecoin-based payment systems, recognizing their potential to revolutionize international money transfers by reducing cost and increasing speed. Meanwhile, in developing countries where inflation often erodes local currencies, stablecoins offer a more accessible and affordable alternative for everyday transactions, as noted by Maruf Yusupov of Deenar.

As stablecoins become increasingly embedded in the financial fabric, their role as a bridge between traditional banking and the burgeoning digital economy is becoming undeniable. The GENIUS Act represents a crucial step in this journey, providing the regulatory foundation necessary to support innovation while protecting consumers. With market capitalization soaring and institutional backing growing, stablecoins are no longer a fringe phenomenon but a central player in the future of finance.