Gallium nitride (GaN) and high-bandwidth memory (HBM) are at the forefront of a dramatic transformation in the global electronics industry, promising to redefine everything from data centers and electric vehicles to advanced robotics and AI infrastructure. As of August 2025, these technologies are not just buzzwords—they’re rapidly becoming the backbone of next-generation hardware, unleashing new waves of innovation and competition across multiple sectors.

According to TrendForce, the GaN power device market is poised for explosive growth, expected to leap from USD 390 million in 2024 to a staggering USD 3.51 billion by 2030. That’s a compound annual growth rate (CAGR) of 44%—a figure that would make any investor sit up and take notice. GaN’s unique material properties, especially its ability to handle high frequencies and deliver superior efficiency in compact packages, have made it the darling of power electronics. Initially, GaN made headlines in the world of fast chargers for consumer electronics, where its high efficiency and power density led to smaller, more portable chargers. But that was just the beginning.

Now, GaN’s reach is expanding rapidly. From artificial intelligence (AI) data centers and humanoid robots to onboard vehicle chargers and photovoltaic microinverters, its advantages are driving a new era of technological transformation. One of the most significant pushes comes from NVIDIA, which is actively promoting a shift to 800V high-voltage DC (HVDC) infrastructure in data centers. By 2027, these centers are expected to support IT racks with power loads exceeding 1MW, and GaN’s high-frequency, high-efficiency characteristics are tailor-made for such demanding environments. Several GaN vendors have already announced partnerships with NVIDIA, signaling just how central this technology is becoming in the AI hardware race.

But why does this matter? As AI workloads balloon, the need for power-dense, thermally optimized, and energy-efficient solutions becomes critical. GaN steps in precisely here, offering the performance edge needed to keep AI data centers running smoothly—and sustainably.

Meanwhile, the world of robotics is also feeling the GaN effect. Humanoid robots, once confined to research labs, are increasingly moving into commercial applications. These machines require incredibly precise, responsive, and compact motor control systems—a challenge that GaN technology is uniquely positioned to address. As of August 2025, multiple manufacturers have rolled out GaN-based joint motor drive reference designs, aiming to deliver compact and efficient motion control for the next generation of robots.

Automotive applications are another major frontier. GaN is becoming an attractive option alongside traditional silicon (Si) and silicon carbide (SiC) components. Vehicle onboard chargers (OBCs) are trending toward lighter, smaller designs, and GaN-based bidirectional systems can significantly improve both power density and performance. While there are still some hurdles to overcome for traction inverter applications, the potential for GaN to boost electric vehicle (EV) performance and range is drawing serious attention from automakers. As wafer sizes shift toward 8-inch and 12-inch formats in the coming years, manufacturing costs are expected to fall, making GaN even more competitive—especially in markets where cost sensitivity is paramount.

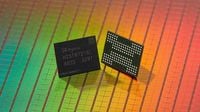

It’s not just about GaN, though. The memory segment is also undergoing a revolution, with SK Hynix forecasting a 30% annual growth rate in high-bandwidth memory (HBM) demand through 2030. HBM technology, which stacks chips vertically to reduce power consumption and physical footprint while improving data-processing efficiency, is now at the heart of advanced AI applications. The custom HBM sector is expected to hit tens of billions of dollars by 2030, driven by the relentless performance requirements of next-gen AI workloads.

Choi Joon-yong, head of HBM business planning at SK Hynix, told Reuters, “AI demand from the end user is pretty much, very firm and strong… Each customer has different taste.” He added, “We are confident to provide, to make the right competitive product to the customers.” In other words, SK Hynix is betting big on customization as a path to resilience in a market increasingly shaped by the unique needs of major cloud service providers like Amazon, Microsoft, and Google.

Capital spending from these tech giants could increase, further fueling AI infrastructure expansion and, in turn, HBM demand. SK Hynix’s position as NVIDIA’s primary HBM supplier underscores its influence in the AI hardware space. However, the semiconductor world is nothing if not cyclical. Samsung recently cautioned that near-term HBM3E production might outpace market demand growth, potentially putting downward pressure on prices. It’s a reminder that while the future looks bright, oversupply and pricing pressures are never far off in this industry.

On the geopolitical front, the landscape is shifting as well. The threat of US tariffs—reportedly as high as 100% on semiconductor chips from countries without American manufacturing operations—has caused ripples of concern. Yet, South Korean officials have indicated that SK Hynix and Samsung Electronics would likely escape these measures, thanks to their ongoing and planned US investments. SK Hynix, for example, is ramping up US manufacturing capacity, including an advanced chip packaging plant and an AI research facility in Indiana, to insulate itself from potential trade disruptions. In 2024, South Korea’s chip exports to the US were valued at $10.7 billion, with HBM shipments to Taiwan for packaging also rising sharply.

So, where does all this leave the industry? Both GaN and HBM are entering what many analysts are calling a "golden period" of growth, driven by cost-effectiveness, multi-sector adoption, and the relentless march of AI and electrification. As large-scale production of GaN matures and wafer sizes increase, costs are expected to drop, making the technology accessible to a broader range of applications—from data centers and EVs to robotics and renewable energy. Meanwhile, the HBM segment is set to ride the AI wave, with custom solutions and strategic investments helping major players navigate an ever-evolving market landscape.

Of course, challenges remain. The semiconductor industry’s cyclical nature means that periods of oversupply and price volatility are inevitable. Yet, the sheer pace of innovation—and the scale of potential applications—suggests that both GaN and HBM will continue to be central to the electronics industry’s evolution in the years ahead. For now, the message from the world’s leading chipmakers is clear: the future is bright, and the race to power tomorrow’s technology has only just begun.