GameStop's recent foray into the cryptocurrency market has sent shockwaves through the financial world, as the company announced plans to allocate a significant portion of its cash reserves to Bitcoin. However, this bold move has not been without controversy, leading to a dramatic plunge in its stock price.

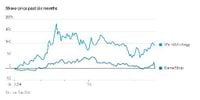

On March 27, 2025, GameStop revealed its intention to invest in Bitcoin and US dollar-pegged stablecoins, aiming to allocate a portion of its $4.8 billion cash reserve to these digital assets. This announcement initially sparked excitement, causing GameStop's stock to rise 16% during the day. However, the enthusiasm was short-lived. Following the announcement, the company disclosed plans to issue $1.3 billion in convertible senior notes to finance this investment strategy. This move raised eyebrows among investors, leading to a nearly 25% drop in the stock price, which fell as low as $21.16.

Analysts have expressed skepticism regarding GameStop's decision to invest heavily in Bitcoin, especially given the company's ongoing struggles in the traditional retail market. "GameStop is raising money from sophisticated investors and leaving its shareholders with the risk of ruin," noted industry observers. The company's core business has been in decline for over a decade, with physical video game sales dwindling in the digital age.

Despite the initial surge in stock price, the announcement of the convertible notes offering triggered a significant sell-off. On the same day, GameStop's stock plummeted 22%, prompting a short sale restriction on the New York Stock Exchange due to a staggering 234% increase in short volume. Nearly 31 million shares were sold short, marking one of the largest spikes in recent history.

Investors are wary of the company's foray into cryptocurrency, viewing it as a risky distraction from its fundamental business challenges. "It feels a little like… I’m going to buy some Bitcoin with our excess cash because we can’t find a company that is going to be accretive," said Tastylive CEO Tom Sosnoff. This sentiment echoes concerns that GameStop is not addressing its structural decline but instead is leaning into speculative assets.

GameStop's strategy involves issuing convertible senior notes, a financial instrument that allows the company to raise funds while giving lenders the option to convert their debt into equity. However, the lack of interest on these notes, which is somewhat unusual, raises questions about the long-term viability of this approach. If GameStop's stock performs well, lenders may convert their debt into shares, potentially benefiting from a rise in equity value.

As GameStop navigates this turbulent financial landscape, analysts have been critical of its direction. Wedbush analyst Michael Pachter has assigned a "Moderate Sell" rating to GameStop, with a price target of $10. He emphasized that while the company has about $10 per share in cash, there is no clear plan for utilizing these funds effectively.

In the broader cryptocurrency market, Bitcoin's price has also seen volatility. On the same day that GameStop announced its plans, Bitcoin briefly approached $89,000 before retreating to around $86,500, reflecting a 3% drop. Other major cryptocurrencies, including ether (ETH) and solana (SOL), also experienced declines of 3% to 4%. The CoinDesk 20 Index, which tracks the overall cryptocurrency market, dropped 1.9% in 24 hours.

The decline in cryptocurrency prices coincided with weakness in US equities, as the S&P 500 and Nasdaq fell 0.8% and 1.6%, respectively. Analysts attributed this downward trend to renewed uncertainty surrounding the US debt ceiling and upcoming tariffs set to take effect on April 2. "Uncertainty surrounding US trade policy and the broader political landscape remains front of mind," stated analysts at QCP Capital.

In light of the challenges facing GameStop, the company's decision to invest in Bitcoin raises questions about its long-term strategy. While the initial announcement generated excitement, the subsequent drop in stock price and skepticism from analysts suggest that investors are not convinced this is a sustainable path forward. As GameStop continues to grapple with its core business challenges, the risks associated with its cryptocurrency investments may overshadow any potential benefits.

In summary, GameStop's venture into Bitcoin investment has ignited a heated debate among investors and analysts alike. While the company seeks to adapt to a changing market, its reliance on speculative assets raises concerns about its long-term viability. With the stock price plummeting and investor confidence waning, the future of GameStop remains uncertain as it navigates these turbulent waters.