Once upon a time not long ago, the dream of flying taxis, or eVTOL (electric Vertical Take-Off and Landing) aircraft, seemed so close it was almost tangible. Here at Ground Zero, the race was on to see glistening metallic marvels whizzing above our heads. But alas! The sky seems to be darkening for many startups vying to put these flying cars on the map, particularly in Europe and the U.S.

Vertical Aerospace, a UK-based eVTOL startup, recently secured $50 million from American debt investor Mudrick Capital, giving it some much-needed breathing space. Founded by Stephen Fitzpatrick, who is set to scale back his hands-on role, Vertical has been grappling with soaring costs and delayed timelines. This financial lifeline has been described as "crucial," particularly as the startup seeks to accelerate its VX4 aircraft development for commercial operations anticipated by 2028. The recent cash injection includes converting $130 million of Mudrick’s loans to equity, thereby transforming Mudrick’s ownership stake from around 30% to over 70%. Put simply, this deal certainly shifts the power dynamic within the startup. Fitzpatrick voiced his optimism, stating, "The additional equity and stronger balance sheet will enable us to fund the next phase of our development program and deliver on our mission to bring this amazing electric aircraft to the skies." But let’s not mince words; it’s still precarious footing for Vertical, which has lost around 95% of its market value since going public.

To highlight the challenges faced by eVTOL startups, let’s take a detour to Germany. There, Lilium, another notable competitor aiming to revolutionize urban transport with its own eVTOL design, has filed for bankruptcy. Investors are growing more discerning, causing many promising startups to scale back or regroup amid tight funding environments. For many, the ambitious projections for fleet launches quickly turned from July dreams to harsh October realities. The cash crunch across the sector raises questions: Can flying taxis become reality before they fade back to fantasy?

Meanwhile, across the Atlantic, Heart Aerospace, hailing from Sweden, is gearing up to test its own electric aircraft, the Heart X1. Slated for its inaugural flight at Plattsburgh International Airport next year, the test is seen as pivotal for the company’s ES-30 project, which aims to be the largest fully electric aircraft ever put through the skies. The X1 trial is part of the validation process for its innovative hybrid-electric propulsion system, combining electric engines with turboprops, purportedly to improve reliability and performance. Christina Zander, Heart Aerospace’s Head of Communications, described it as part of the step-by-step maturation of these new technologies. “The Heart X1 will be used to mature the independent hybrid-electric propulsion system, targeting fully electric flight,” she stated.

Heart’s ambition doesn’t stop there. They are also committed to developing future prototypes, such as the Heart X2, to support the ES-30’s certification. With their established pilot plant and the right test locations, the Swedish company aims to be on solid ground within the next decade.

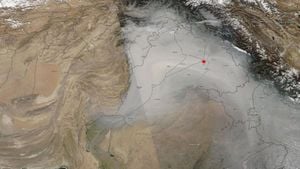

Switch gears to the Indian startup scene, where ePlane Company is bold and unyielding. With ambitions to launch cargo operations by 2025 and passenger flying taxis by 2026, ePlane has its eyes set on the prize. The prototype under development is expected to handle two passengers plus 200 kilograms of cargo, zooming across the skies at 180 kilometers per hour. If successful, they might just put the Indian drone and eVTOL market on the international map.

But the harsh reality for many startups shows no signs of letting up. Money poured heavily at the onset of the eVTOL revolution—many were optimistic about transforming urban mobility. Now, the slowdown has led to disillusionment among investors, who grow concerned about rising development costs and the lengthy path toward certification. The initial buzz has faded, leaving startups grasping for distinctive selling points to revitalize interest and secure additional funding.

What does this spell for future urban air mobility? Each company faces elemental questions about operations, regulations, and most significantly, the financial means to emerge from development hell. Investors now walk knots of skepticism and caution, aware of the tangible challenges facing those daring to take flight. The irony is pressing: these companies are literally chasing the skies, yet their feet remain mired firmly on the ground.

For spectators and enthusiasts, the excitement exists amid loss, struggle, and perseverance. Vertical, Heart Aerospace, and ePlane have become symbols of trial, error, and the unyielding human spirit, embracing the exhilaration and trepidation of flying taxis. Only time will tell if these lofty aspirations become standard practice or serve as footnotes in aviation history.

Still, one might wonder, even incredulously, is this the end of the eVTOL dream? Perhaps, with calculated risks and innovative designs, the sky might yet be the limit. For the sake of legions dreaming of flying taxis, may these bold companies find the funds and the courage to push onward, because, at the end of the day, who wouldn’t want to skip the city traffic and soar above it all instead?