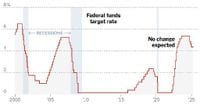

As the U.S. Federal Reserve gears up for its critical monetary policy meeting, market analysts expect the central bank to maintain its benchmark interest rate in the 4.25% to 4.5% range on March 19, 2025. This will mark the second consecutive meeting where no changes are anticipated, aimed at navigating through the economic uncertainties exacerbated by President Donald Trump's tariff policies.

The Fed is set to unveil its latest monetary policy statement at 2 p.m. EDT, followed by a press conference from Fed Chair Jerome Powell at 2:30 p.m. Investors and analysts will closely watch for clues about the direction of future rate changes, especially in light of evolving inflation and growth projections in the U.S. economy.

"The FOMC is broadly expected to keep its policy stance unchanged for a second consecutive meeting," stated analysts from TD Securities, as predictions solidify around the Fed's cautious approach amid the current economic volatility.

While the Fed has previously trimmed rates by a total of 0.75% during 2019 in response to economic shifts, analysts are predicting a more measured response this year, including only one or two cuts dependent on how tariffs influence inflation and growth. The Fed will also publish its revised Summary of Economic Projections (SEP), which provides an outlook on various economic indicators, including GDP growth and inflation.

In December, the Fed estimated that the economy would grow at a modest 2.1% this year and projected an annual Personal Consumption Expenditures (PCE) inflation rate of 2.5%. However, recent data introduces considerable caution surrounding these figures. Specifically, the Federal Reserve Bank of Atlanta’s GDPNow model currently forecasts a contraction of 2.4% in the first quarter due to economic pressures.

With inflation still trailing above the Fed's targeted 2% threshold, the ongoing concern regarding Trump's tariffs has underscored the uncertainty. When the Fed last revised its growth forecasts, it presented a tempered view reflecting apprehension over trade policy impacts, aligning with broad market sentiment. According to Steven Blitz, chief U.S. economist at TS Lombard, "Trump is engineering a 'trade shock' that will drop the economy to a lower growth path." This sentiment captures the apprehension prevalent in both economic and investment circles.

The remarks made by Powell during press conferences in previous months have highlighted a more reactive approach the Fed may adopt towards Trump's tariffs and general economic condition. Analysts surmise that a persistent pattern of tariff-related shocks could disrupt the Fed's previous assessments of temporary price pressures. The potential for tariffs to induce a sustained rise in inflation complicates the Fed's decision-making mechanisms.

As expectations grow for the Fed to address maintaining growth while navigating inflationary pressures, market observers will not only be looking at the rate decisions but will be focused on the projections and forecasts laid out in the new SEP. Powell has indicated the Fed's intent to scrutinize economic signals vigorously, particularly in light of tariffs and their influence on market sentiment.

Investors are increasingly concerned about the broader implications of Trump’s tariff strategies, noting that they could have tangible effects on consumer confidence which is already showing signs of strain. "The tariffs are very fluid right now," said Ron Vachris, CEO of Costco, reflecting the sentiment shared by many corporate leaders reducing their forecasts regarding economic growth.

In contrast to the expected stability in rates, Powell's subsequent comments could sway market perspectives significantly, particularly around inflation and consumer confidence metrics. If Powell addresses the tariff situation with considerable concern, it could indicate a more cautious monetary policy trajectory moving ahead.

As consumer rates stand at elevated levels, businesses and consumers alike are prepping for the Fed's announcement, anticipating impacts across many sectors including housing and investments. For instance, the average rate on a 30-year fixed-rate mortgage clocked in at 6.81% in mid-March 2025, a stark increase from 4.29% previously, imparting a ripple effect on home affordability.

Furthermore, with credit card rates averaging 20.09%, the potential for changes in Fed policy could also influence borrowing costs considerably. Market denote that the Fed’s decisions undoubtedly carry weight across financial landscapes, revealing how tethered the broader economy has become to the central bank’s outputs.

The ongoing uncertainty around the Fed's policies and U.S. economic strategies under Trump's administration serves as a reminder that the delicate balance between consumer confidence and inflation remains a central pillar of future economic health. Analysts await the details from Powell’s press conference, hoping for clarity around the Fed's outlook and stances as we head further into 2025.