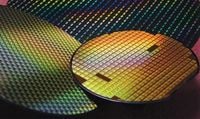

In a significant move for the European semiconductor industry, nine European Union nations have recently established the Semiconductor Alliance, aimed at boosting competitiveness in a sector that is crucial for digital devices and technology. Announced on March 12, 2025, the alliance includes Austria, Belgium, Finland, France, Germany, Italy, Poland, Spain, and the Netherlands but notably excludes Greece, prompting conversations about the adequacy of the Greek Ministry of Development's response to the semiconductor strategy.

The Semiconductor Alliance’s primary objective is to accelerate the development of a robust semiconductor industry in Europe and to launch a subsequent EU funding initiative known as Chips Act 2.0, which seeks to strengthen the continent's semiconductor capabilities and reduce dependence on Southeast Asia for critical technologies.

Despite these advancements in the EU, Greece's absence from the alliance highlights a troubling trend of inaction by the Greek Ministry of Development. Although the former Minister, Kostas Skrekas, had made plans for a national semiconductor strategy by contracting McKinsey to devise it, the process has stalled. Reports indicate that although funding was secured in November 2024 as part of the ministry’s Sectoral Development Program, the necessary contract with McKinsey has yet to be signed.

Current Minister Takis Theodorikakos assured stakeholders of a commitment to finance the establishment of Greece’s first Semiconductor Competence Center, promising 3.6 million euros for its development. However, progress in implementing these initiatives has been criticized as sluggish, with industry insiders warning that Greece risks missing out on opportunities in a rapidly evolving market.

Furthermore, while the local industry is small but thriving, the inability to tap into the expertise of Thomas Skordas, the deputy director-general of the EU’s Directorate General for Communications Networks, Content and Technologies (DG Connect), remains a significant missed opportunity for Greece.

In parallel, shares of Dutch semiconductor giant ASML Holding have faced declines, despite the growing anticipation surrounding new European legislative actions aimed at enhancing the semiconductor landscape. Following reports that nine EU countries are collaborating to finalize proposals to boost the chip industry by summer 2025, Dutch Economy Minister Dirk Beljaarts commented on the preparations being made for this new act, which he referred to as a follow-up to the 2023 Chips Act.

ASML has found itself in a challenging position, as investor confidence waned with its shares dropping nearly three percent amid caution regarding immediate outcomes from the initiatives. This concern among investors comes despite the Dutch government expressing optimism about targeted funding approaches, promising to allocate both private and public funds aimed at supporting small and medium-sized enterprises within the sector.

Beljaarts has emphasized the need for a focused strategy moving forward, stating, “We need to allocate funds, both private and public, to push the sector, also to make sure that the trickle-down effect takes place and that small and medium-size companies also benefit.” This statement echoes concerns from industry experts who note that the overarching ambitions of the first Chips Act did not translate into tangible achievements due to the slow pace of project approvals by the European Commission and member states.

In response to these concerns, recent gatherings of chip manufacturers and semiconductor supply chain companies, including ASML, have called for supporting measures that focus not only on boosting manufacturing capacity but also enhancing areas like chip design, materials, and equipment. The potential for a second funding package appears promising, but the demand for expedited processes remains loud and clear.

Intel and Wolfspeed, both significant players in the semiconductor landscape, have recently announced delays in establishing new production facilities in Europe, citing that economic conditions shifted during the protracted approval period. This further highlights the urgency for Europe to reinforce its semiconductor prowess if it is to keep pace with formidable competitors such as the US and China.

As the landscape unfolds, it becomes evident that while some progress is being made across European nations to bolster the semiconductor industry, Greece’s hesitance to engage effectively in these initiatives casts shadows over its future potential in this ever-critical technology sector. With nine nations rallying around the Semiconductor Alliance and discussions of Chips Act 2.0 gaining traction, it raises the question: will Greece manage to catch up, or will it continue to lag behind as Europe forges ahead in the global semiconductor race?