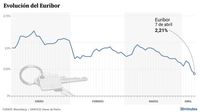

On April 7, 2025, the daily Euribor rate experienced a notable decline, settling at 2.21%, which is a decrease of 0.025 points from the previous day. This marks the lowest rate recorded since September 2022. The Euribor, or Euro Interbank Offered Rate, is a vital index that reflects the interest rate at which major European banks lend to one another, and it serves as a benchmark for most variable-rate mortgages in Spain.

The recent drop in the Euribor rate can be attributed to several factors, including the ongoing trade policy initiated during the Trump Administration. This policy has raised concerns about a potential recession in the United States, causing ripples throughout global markets. As the market reacts to these uncertainties, the European Central Bank (ECB) is expected to adjust its interest rate strategies, which in turn influences the Euribor.

As of now, the average Euribor rate for April stands at 2.272%, down from 2.398% at the end of March. This trend of decreasing rates provides relief to borrowers with variable-rate mortgages, who had previously faced significantly higher monthly payments. In October 2024, the Euribor peaked at 4.17%, leading to soaring mortgage costs for many homeowners.

Simone Colombelli, the director of mortgages at iAhorro, commented on the unpredictable nature of the Euribor, stating, "This month the Euribor has shown us once again that we cannot make predictions about its evolution because, in a week, its trend can change significantly. This indicator is heavily influenced by what happens politically, socially, and economically in Europe, which is why it surprises us."

In practical terms, the decline in the Euribor translates to lower mortgage payments for many homeowners. For instance, a typical mortgage of €140,000 over 30 years, with a 1% differential, would see a monthly payment drop from €726.35 in April 2024—when the Euribor was at 3.703%—to €584.55 based on the average for March 2025. This represents a saving of €141.80 per month for those whose mortgage terms are up for revision.

The recent trends also suggest that the Euribor could remain below 2% throughout 2026, with futures indicating an end-of-year rate of 1.71%. These projections are encouraging for homeowners, as they suggest continued affordability in mortgage payments.

The Euribor is calculated daily based on the average interest rates at which banks lend to each other, and it is published every weekday at 11:00 AM. The current methodology includes both panel data from banks and market estimates to enhance accuracy and reduce volatility.

Historically, the Euribor has seen significant fluctuations. After a period of stability, it began to rise sharply in 2022, coinciding with the ECB's interest rate hikes aimed at curbing inflation. The index typically responds to changes in monetary policy and broader economic conditions, making it a key indicator for both consumers and investors.

In the context of the Spanish housing market, the current environment presents a unique opportunity for buyers. According to a recent survey by Fotocasa Research, the percentage of Spaniards purchasing homes without needing a mortgage has increased significantly, from 27% in 2022 to 35% in 2024. This trend highlights a shift in buyer behavior, likely influenced by the rising costs associated with variable-rate mortgages.

As the financial landscape evolves, many buyers are taking advantage of fixed-rate mortgage offers, which provide a stable payment structure amidst the uncertainty of variable rates. The increasing availability of competitive mortgage products, especially from digital banks, is further fueling interest in home purchases.

Overall, the current decline in the Euribor offers a glimmer of hope for homeowners and potential buyers alike. With lower rates and a more favorable mortgage environment, many are now considering entering the housing market or refinancing existing loans.

As we move forward, the interplay between global economic conditions, local market dynamics, and monetary policy will continue to shape the future of the Euribor and the broader financial landscape.