Manufacturers, farmers, and small business owners across the United States are feeling the repercussions of escalating trade tensions, particularly through the lens of new tariffs announced by President Donald Trump. As uncertainties loom regarding the impact of these tariffs, various sectors are bracing for potential price increases and economic strain.

Among the most affected are Wisconsin’s agriculture and manufacturing sectors, both of which are facing retaliatory tariffs from foreign nations such as Canada and China. According to a report by Wisconsin Public Radio, almost 10 percent of Wisconsin's jobs, equating to nearly 300,000 jobs, are in industries targeted by these incoming tariffs. Kip Eideberg, senior vice president for the Association of Equipment Manufacturers, noted the widespread concern, stating, “If we are dragged or pushed into a recession as a result of the tit for tat tariffs, that’s a whole ’nother level of pain.”

The crux of the issue lies in the tariffs imposed by the U.S. government on steel and aluminum imports, which have incited reciprocal actions from Canada and Europe. Canada is applying a staggering 25 percent tariff on approximately $60 billion worth of American goods, while the European Union is finalizing countermeasures that could potentially affect $28.6 billion worth of U.S. exports. The situation is precarious, with Canadian tariffs specifically targeting major imports from American manufacturers, including tractors and agricultural machinery.

Amid these financial constraints, workers in Wisconsin's agriculture sector, which contributes around 353,900 jobs, are experiencing the trickle-down effect. Amy Pechacek, secretary for the state’s Department of Workforce Development, expressed her concerns over this matter, emphasizing that “manufacturing and agriculture are the state’s top two industries.” She pointed out that Wisconsin agriculture exported $26.3 billion worth of manufactured products last year, making it crucial for the overall economy.

As these tariffs escalate, many local businesses are facing unprecedented challenges. The equipment manufacturers are already reporting a slowdown in production rates and a spike in inventory levels. “We’ve seen member companies draw down production to adjust to bearish market conditions,” Eideberg revealed. Furthermore, some companies are placing announced hiring on hold and cutting back on research and development investments as they try to mitigate risks in such uncertain economic times.

Notably, the retaliatory tariffs are not just impacting manufacturing but also penetrating the agricultural landscape. Tariffs implemented by China on American farm products, raising rates between 10 to 15 percent, threaten to limit Wisconsin farmers’ access to lucrative markets. Jeff Hadachek, an assistant professor of agricultural and applied economics at the University of Wisconsin-Madison, commented on this situation, stating, “At a very basic level, it means there will be a glut of food and food products that can no longer leave [the country] or [will leave] at a higher cost than they previously did.”

Looking to the global market, Wisconsin farmers might find their paths blocked more than just by tariffs. After observing the automatically enacted tariffs, products like fresh fruit, dairy products, and even poultry are now subject to heavy tariffs from Canada. Agricultural exporters face longer shipping times, increasing operational costs, and squeezing profit margins as they work under the threat of tariffs.

Even within the wine industry, companies like Fabrizia Spirits are navigating treacherous waters. Phil Mastroianni, founder of Fabrizia Spirits, anticipates facing exorbitant tariffs on their Sicilian sparkling wine orders if the threatened 200% tariff on European alcohol is enacted. “It’s a $70,000 question for Phil Mastroianni,” he remarked, highlighting the precarious balance between negotiating tariffs and maintaining their business.

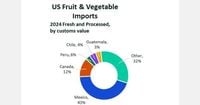

However, it’s not just the liquor industry that feels the impact. President Trump’s proposed tariffs, expected to take effect on April 2, 2025, will impose a considerable 25% tax on products from Mexico and Canada—America's most vital agricultural trade partners. The effect on breakfast staples such as avocados, maple syrup, and fresh produce will be immediate, and consumers might feel the weight of these prices.

As consumers start to stockpile their preferred wines, small businesses that rely on these products find themselves in difficult situations. Wine.com saw a reported 72% shift towards imported wines following the tariff announcements, straining local wineries who predominantly depend on the Canadian market, which comprises 35% of U.S. wine exports.

As the situation fluctuates, growers and distributors in Mexico are scrambling to adjust their strategies. Chris Ciruli, a partner of PennRose Farms LLC, mentioned the challenges posed by the uncertainty in the tariff environment, reflecting on how the back-and-forth over imports has sparked adaptations within the industry, especially as growers reconsider their stock levels of produce.

As trade relations continue their unpredictable path, there’s a palpable anxiety in the business community, one that deepens with each new announcement regarding tariffs. With April 2 fast approaching, the clock is ticking for businesses to adapt or face significant repercussions in the coming months.