Chief Economic Advisor V Anantha Nageswaran recently highlighted the enduring significance of gold as both an investment asset and cultural emblem, emphasizing its increasing relevance amid current economic dynamics. Speaking at the IGPC-IIMA Annual Gold and Gold Markets Conference 2025, Nageswaran reiterated the notion of gold remaining important as a diversification tool within investment portfolios, particularly until the world transitions to a coherent international monetary system.

"Gold will remain relevant not only as a store of value, but also as an important portfolio diversification mechanism until such time the world is able to arrive at an international monetary system from the current international monetary non-system," Nageswaran stated, expressing his views on the current economic climate. He acknowledged the complexity of predicting when major shifts may occur, remarking, "That day of reckoning is very difficult for any one of us to prophecy at this stage."

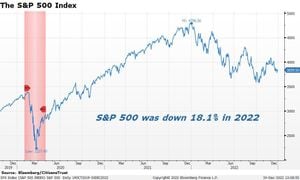

Over the last few months, the value of gold has noticeably surged, increasing by over USD 200 per ounce, or approximately 8%, bringing the current price to around USD 2,860 per ounce. By comparison, the Indian stock markets have witnessed over 8% declines during the same period. Interestingly, this rise follows a long-term trend; since 2002, the price of gold has multiplied nearly tenfold, up from around USD 250 to USD 290 per ounce.

With India being one of the largest net importers of gold, Nageswaran underscored the country's unique relationship with this precious metal. He pointedly remarked on Indians' cultural and religious affinity for gold, stating, "...but probably people attach different significance to gold, and sometimes we tend to forget..." This awareness of cultural nuances plays heavily on India's economic narrative as well.

Nageswaran stressed the significance of remembering gold not merely as monetary value but as part of cultural identity—especially as inflation concerns loom large and economic policies evolve. The global economic narrative shifted dramatically over the decades, with national debts swelling dangerously high, leading investors and policymakers alike to pursue relief measures to service these debts, potentially contributing to inflationary pressures.

He pointed to this swelling global debt-to-GDP ratio, noting, "...when such high levels of debt accumulates, debt becomes deadweight because future earnings are required merely to service the debt and not so much is available for development expenditure." This presents challenges since it can tempt governments to leverage inflation as means of mitigating the real value of debt.

Despite the economic woes, Nageswaran stated India's GDP growth is decently projected at around 6.5% for FY25, aiming for reductions within the country's debt-to-GDP ratio. According to the Fiscal Responsibility and Budget Management Act, the government anticipates the debt ratio dropping to 56.1% by FY26 from 57.1% in FY25.

Looking forward, Nageswaran expressed hope for India to optimize its gold assets constructively, aligning them with national interests without jeopardizing the cultural and symbolic significance they hold. This would require careful navigation of past experiences, including reviewing efforts like the Gold Monetisation Scheme introduced back in 2015 to facilitate the productive engagement of gold assets.

“That is where the policy challenge lies,” Nageswaran reflected, indicating the need for thoughtful deliberation around gold monetization efforts and investor engagement strategies based on past developments. He remained cautious yet optimistic about gold's potential role in diversifying investment portfolios, especially if the precious metal continues to be viewed as both valuable and culturally significant.

To sum up, enduring conversations surrounding gold’s role points to broader themes such as economic reliability, cultural significance, and portfolio diversification—hallmarks of prudent financial strategy and identity. Nageswaran's insights remind investors and policymakers to remain cognizant of these elements as they navigate economic uncertainty and pursue strategies for sustainable fiscal growth.