South Korean stocks faced significant declines as the stock market reopened following the Lunar New Year holiday, largely due to the aftershocks from the emergence of DeepSeek, a Chinese artificial intelligence (AI) startup. This downturn was particularly led by key players in the tech sector, as concerns over investment shifts prompted by DeepSeek's innovative, cost-efficient AI models rattled investor confidence.

On January 31, 2025, the benchmark Korea Composite Stock Price Index (KOSPI) closed down 27.23 points, or 1.07%, settling at 2,509.57. The foreign investor sell-off, which amounted to 834.7 billion won, heavily influenced this decline, as they dumped shares following DeepSeek's introduction of competitive models targeting existing market giants.

DeepSeek’s release of its V3 model, capable of competing with advanced products from U.S. tech giants such as OpenAI and Anthropic, ignited interest and controversy across the industry. Training costs for the new model reached approximately $5.58 million, drastically lower than the hundreds of millions spent by its competitors. Analysts noted, "The paradigm of large-scale investment being necessary for AI growth has changed," as stated by Song Myung-sup, from iM Securities.

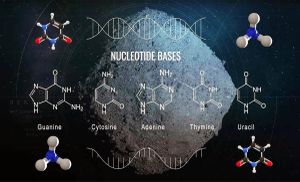

DeepSeek's series of innovations, including its R1 model and the newly introduced V3, have grabbed attention not only for their performance but also for their efficiency. By utilizing fewer computational resources, DeepSeek has emerged as a formidable player, prompting substantial shifts within the global AI sector. The company’s methodology focuses on mathematical ideas like 'sparsity' and effective memory compression, allowing it to maximize output with minimal investment.

Consequently, market leaders like Samsung Electronics and SK hynix, who have traditionally benefited from AI’s rapid advancements requiring high-capacity chips, found their positions threatened. Samsung’s stock fell by 2.42% to 52,400 won, and SK hynix plunged 9.8% to 199,200 won, as investors reassessed future chip demands driven by the advent of cost-effective AI solutions.

This wave of change has not only affected large corporations but has also shifted investor interest within different segments of the market. While many tech shares suffered, companies such as Naver and Kakao benefitted from the disruption. Naver’s stock surged by 6.13%, reflecting optimism around decreased development costs for AI models. Analysts believe if open-source models like those from DeepSeek become widely adopted, firms like Naver could see operational costs drop dramatically.

Further amplifying this narrative, the recent volatility reflects the broader geopolitical climate. The competition between the U.S. and Chinese firms has intensified, with concerns about potential repercussions stemming from restrictions on exports of AI technology to China, signaling possible shifts in the semiconductor supply chain.

Despite these recent disruptions, industry experts predict sustained long-term growth for Korean semiconductors, as Nvidia's and DeepSeek's advancements hold considerable promise. Observers note, "While DeepSeek's R1 was developed using Nvidia GPUs, the algorithm has the potential to yield even greater results if applied to superior chips," as opined by Lee Jong-hwan, professor of system semiconductor engineering.

The finger is increasingly pointed at the need for greater efficiency across AI development as investment strategies adapt. Samsung Electronics and SK hynix will have to navigate through uncertainties to maintain their foothold amid changing dynamics affecting the AI memory chip market.

Analysts have weighed in on how the emergence of such efficient AI models might influence future investment behaviors. Observers predict, "Even though DeepSeek’s innovations may disrupt traditional AI infrastructures, the demand for high-performance memory chips, such as HBM, is not likely to dissolve entirely.”

Overall, the broader market response indicates heightened intrigue surrounding DeepSeek’s models and their potential to democratize access to advanced AI, reshuffling investment priorities as major players work to adapt to this unprecedented shift. This trend underlines the growing importance of cost-effective solutions within the tech industry as attention shifts to affordability and accessibility.

DeepSeek's rise serves as both a challenge to traditional models of investment within tech and as an illustration of the shifting tides within global technology markets. The lasting impacts of these changes will determine how companies respond and evolve as they adjust their strategies to retain competitive advantages.