In a remarkable display of resilience amidst global economic challenges, 13 companies in South Korea have achieved what is termed a 'quantum jump' in sales, increasing their revenue by over 400% in the last five years. This growth, highlighted in a report by CEO Score on April 23, 2025, includes notable names such as Coupang, Samsung BioLogics, and CJ Olive Young. The report analyzed the financial performance of 407 of the top 500 companies in Korea, excluding financial institutions, comparing their 2019 and 2024 fiscal results.

According to the findings, the total sales of these surveyed companies surged by 42.1%, rising from 2,156 trillion won in 2019 to an impressive 3,064 trillion won last year. Operating profits also saw a significant increase, climbing by 77.5% from 110 trillion won to 195 trillion won during the same period.

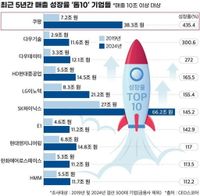

Coupang, the only company among the 13 to exceed 10 trillion won in sales, reported a staggering 435% growth, jumping from 7.2 trillion won in 2019 to 38.3 trillion won in 2024. This surge is attributed to its innovative logistics model, particularly the popular 'rocket delivery' service, which has transformed the online shopping landscape in South Korea.

Other companies that recorded remarkable growth include POSCO Flow, CJ Olive Young, SGC Energy, Woowa Brothers, and Samsung BioLogics, all of which achieved over 400% growth. For instance, CJ Olive Young's sales skyrocketed by 1,209.9%, increasing from 366 billion won to 4.793 trillion won, thanks to enhanced product curation based on customer reviews.

Samsung BioLogics also made headlines with a 548.1% increase in sales, reaching 4.547 trillion won, driven by significant enhancements in research and development as well as production capabilities. This growth reflects a broader trend where companies are diversifying their offerings and entering new markets to boost revenues.

Interestingly, the report also revealed that 44 companies, or 10.8% of those surveyed, experienced sales growth of between 100% and 400%. Among these, notable firms include SK Hynix, HD Hyundai Heavy Industries, LG Innotek, and Hanwha Aerospace, all of which have capitalized on expanding markets and innovative business strategies.

However, the report painted a contrasting picture for some companies. A total of 68 companies, accounting for 16.7%, experienced negative growth over the past five years. This decline is attributed to various factors, including adverse external conditions and weakened internal competitiveness. Among those, Lotte Shopping and Samsung Display were unable to escape the downturn, with Lotte Shopping reporting a 20.6% drop in sales from 17.622 trillion won in 2019 to 13.987 trillion won last year.

Taeyoung Unicity recorded the most significant decline, with a staggering 95% drop in sales, plummeting from 998 billion won to just 50 billion won. This downturn is linked to its parent company, Taeyoung Construction, which has been undergoing a workout for over a year amidst a real estate project financing crisis.

The report also highlighted the growing trend of companies joining the '10 trillion club,' which includes firms with sales exceeding 10 trillion won. This club has expanded from 39 companies in 2019 to 59 in 2024, with newcomers such as Naver, LG Innotek, Hanwha Aerospace, HMM, and HD Hyundai Heavy Industries. Naver's growth is particularly notable, as it joined the club for the first time, increasing its sales from 6.593 trillion won to 10.738 trillion won amid fierce competition with global tech giants.

The success factors for the 57 companies that achieved over 100% growth were classified into several categories. Notably, 23 of these companies (40.4%) attributed their success to entering new markets and diversifying their business models. For example, POSCO Flow expanded its logistics services, resulting in a remarkable 1,725.1% increase in sales.

Similarly, Woowa Brothers, which operates the popular food delivery service Baemin, diversified into quick commerce and B2B distribution, achieving a sales increase of 664.5%. The company's innovative approach to service delivery has positioned it well within the competitive landscape of online commerce.

On the other hand, 20 companies (35.1%) achieved their quantum jump by strengthening their existing capabilities. For instance, CJ Olive Young enhanced its omni-channel strategies and product offerings, while Samsung BioLogics focused on R&D and production improvements to solidify its position as a leader in the biopharmaceutical sector.

Additionally, 14 companies (24.6%) achieved sales growth through collaborations and mergers and acquisitions. Dow Technology, for example, saw its sales increase by 300.6% from 2.902 trillion won in 2019 to 11.626 trillion won last year, significantly benefiting from partnerships with various IT firms.

As the landscape continues to evolve, the stark contrast between the high-growth companies and those experiencing declines serves as a reminder of the volatile nature of the market. While some businesses thrive through innovation and strategic expansion, others face challenges that threaten their viability.

In conclusion, the findings from CEO Score not only underscore the resilience of certain sectors within the South Korean economy but also highlight the importance of adaptability and foresight in navigating the complexities of a globalized market.