Cleveland and San Diego witnessed significant changes in the landscape of homebuying in 2024, with cash purchases declining amid soaring mortgage rates and a saturated housing market. Investors, previously dominant players, are pulling back, which is reshaping local economies and the broader national real estate market.

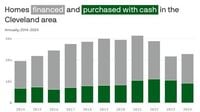

In Cleveland, a notable 40% of homes were purchased in cash, a substantial drop from 48% in 2023, according to a recent analysis by Redfin. This trend reflects a national pattern where the share of U.S. homes bought with cash fell to just under one-third, marking the lowest figure since 2021. Such a decline highlights a shift in the dynamics of homeownership and investment strategies.

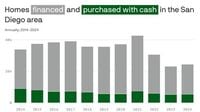

Meanwhile, in San Diego, the cash purchase figure stood at 22%, showing only a slight decrease from the previous year. This percentage placed San Diego in context with other major California markets; it was lower than San Francisco (26.5%) but aligned closely with Los Angeles (22.2%). The trend illustrates how various markets across the nation maintain distinct characteristics influenced by local economic factors.

Despite the overall drop in cash transactions, the cash share in San Diego had peaked at 26.5% in 2014 before gradually declining to 15% in 2020. It had then increased over the subsequent three years but now represents a marginal decrease of 0.6% from 2023 to 2024. This indicates a very delicate balance in a competitive market where cash offers can significantly influence home sales.

Both Cleveland and San Diego markets are experiencing the pressure of high mortgage rates, which are currently hovering around 7%, as reported by Freddie Mac. This rise in interest rates contributes to a broader trend: overall home sales hit a nearly 30-year low in 2024, according to the National Association of Realtors. Sheharyar Bokhari, a senior economist at Redfin, explained that, “We are unlikely to see the share of all-cash purchases fall much lower in 2025, unless mortgage rates drop enough to drive a significant increase in sales.”

As cash buyers, primarily investors, have taken a step back in the wake of the pandemic's initial buying frenzy, potential homebuyers and sellers are adjusting their strategies. The decreased proportion of cash transactions in both markets may also signify potential buyers' challenges in competing against affluent cash purchasers, who tend to have overwhelming advantages in quick purchase capabilities during competitive bidding situations.

This dynamic presents challenges not just for homebuyers but also for local economies reliant on the vibrancy of their real estate markets. Areas like Cleveland are facing broader economic implications as decreased home sales reflect declining investor confidence and purchasing power. Similarly, San Diego’s relatively low cash purchase percentage can indicate potential fluctuations in housing predictability, potentially leading to prolonged downturn periods or shifts in local job markets dependent on real estate stability.

As the housing market continues to evolve, investors and buyers alike are left pondering the future of real estate transactions. Lower cash purchase rates might create opportunities for first-time buyers who have been outpaced in competitive environments. However, higher mortgage rates remain a significant barrier, making financing homes increasingly costly.

In summary, the current landscape of cash home purchases illustrates deeper economic trends across the U.S., from Cleveland to San Diego, reflecting not only the changing nature of investment but also the ongoing shifts post-pandemic. As various stakeholders navigate these circumstances, the real estate market will undoubtedly be a topic of considerable interest and analysis moving forward.