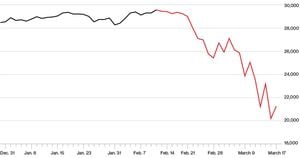

China’s property sector is experiencing promising signs of recovery, marked by heightened interest from institutional investors and hedge funds, following years of turmoil. Recent reports indicate shares of Hong Kong-listed mainland developers surged 15% within February 2025, much to the delight of market watchers.

Leading the charge are significant players such as Shanghai Chongyang Investment and Golden Nest Capital, who are focusing on state-controlled developers to capitalize on what many believe is the dawn of a real estate rebound. This resurgence is largely fueled by government intervention and by the growing confidence of investors, especially as prime city home prices start to increase.

Wang Oing, head of Shanghai Chongyang Investment Management, which oversees $5 billion in assets, has taken proactive measures, adding large state-owned developers to his investment portfolio. He expressed optimism, noting, "The sentiment is turning around due to government support since September 2024."

Investments from firms like Hong Kong's Golden Nest Capital have also seen rises, demonstrating strategic repositioning toward more stable property firms. Notably, Golden Nest's CIO, Stanley Tao, mentioned the sharp decline of new home sales being accompanied by even steeper drops among developers, creating opportunities for resilient players still viable to market recovery.

The resurgence of Hong Kong-listed mainland property stocks—getting the spotlight again—has made them among the best-performing segments, second only to tech stocks. This market turnaround signals shifting sentiments, as internationally, investors once eschewing this sector are beginning to reconsider their stance, influenced by government actions initiated to stabilize the market.

Viewing the broader picture, China's recovery pattern reflects trends elsewhere around the globe. For example, the real estate scenarios in the United States and other major economies such as India, the UK, and parts of the Middle East are showing similar recovery trajectories following pandemic-induced downturns. Specific cities, including New York, San Francisco, and upscale districts of London, are attracting renewed investor interest.

U.S. property values which had plummeted, especially during the pandemic, are again on the upswing, particularly with luxury homes driving consumer demand as remote working preferences linger. Across the pond, European nations, especially the United Kingdom, have also seen rebounds in their respective real estate sectors, particularly high-end markets like Kensington and Chelsea.

Meanwhile, luxury real estate markets are equally thriving within India’s metropolitan centers of Mumbai and Delhi, buoyed by affluent buyers and advantageous government policies. Statistical reports from India’s National Housing Bank show rising figures thanks to tax incentives and novel housing finance solutions spurring demand.

Turning to the Middle East, Dubai has exhibited noteworthy recovery, rebounding strongly post-pandemic. The luxury property segment has flourished, primarily spurred by foreign investments, which are drawn by reasonable property prices complemented by supportive regulations.

Specifically, within the Chinese framework, the pivot toward supporting state-owned developers has been emphasized, with platforms like KE Holdings—similar to Zillow—capturing significant interest from hedge funds. Investments have surged significantly, with Hong Kong-based firms like Aspix Management acquiring substantial shares from KE Holdings.

The shift toward safer, government-backed investments appears to resonate well within investment strategists, as evidenced by the sharp turnaround of previously lagging stocks, marking what some speculate as the worst part of the crisis coming to its end.

Despite signs of recovery, challenges remain, particularly for smaller cities facing significant unsold inventory issues. Yet the overall sentiment indicates optimism, backed by collective measures from regulatory bodies and investors alike. Market participants anticipate sustained government intervention, restructuring efforts, and steadfast price stabilization across lower-tier cities will be necessary for complete recovery.

Looking beyond China, other significant property markets across Asia—including Vietnam and Indonesia—are similarly positioning themselves as attractive options for investment, buoyed by positive economic adjustments and continuous infrastructure development.

With strategic and selective global investments shaping the future of real estate, the prevailing momentum hints at promising prospects as markets continue recovering and engineering new paths to resilience.