In a significant escalation of trade tensions, China has issued a stern warning to South Korean companies, urging them to cease exports of products containing rare earth elements to U.S. defense firms. This directive, reported by the Korea Economic Daily, is part of China's broader strategy to retaliate against tariffs imposed by the United States under former President Donald Trump.

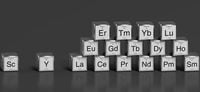

Rare earth elements, which are essential for manufacturing a wide array of high-tech products including transformers, batteries, displays, electric vehicles, aerospace components, and medical devices, have become a focal point in the ongoing trade conflict. The Chinese Ministry of Commerce has made it clear that South Korean firms could face sanctions if they fail to comply with these new export restrictions.

This warning follows China's recent imposition of export controls on rare earths, a move seen as a strategic maneuver in response to the tariffs that have strained trade relations. According to the Korea Economic Daily, these elements are crucial not only for consumer electronics but also for military applications, making the situation particularly sensitive.

China's dominance in the rare earth market is staggering; it produces approximately 90% of the world's supply. The country has previously used its control over these critical materials as leverage in international disputes, notably in 2010 when it halted exports to Japan during a territorial conflict, leading to a spike in global prices.

As of April 4, 2025, China officially announced restrictions on the export of seven heavy rare earth elements and certain magnets, further tightening its grip on this vital resource. The implications of these restrictions are profound, particularly for the United States, which has only one rare earth mine, the Mountain Pass mine in California, operated by MP Materials. This mine produces key oxides such as lanthanum, cerium, neodymium, and praseodymium, but the U.S. is still heavily reliant on Chinese processing capabilities.

Mark A. Smith, CEO of NioCorp, characterized China's actions as a "precision strike" against U.S. defense capabilities, highlighting the vulnerability of American industries that depend on these materials. Luisa Moreno, Director of Defense Metals Corp., echoed this sentiment, stating that the U.S. cannot fully replace China as a supplier and that it could take five to ten years to develop domestic sources of heavy rare earth elements.

With China processing nearly all of the world's heavy rare earth elements, the U.S. finds itself in a precarious position. Gracelin Baskaran, Research Director at the Center for Strategic and International Studies, noted that the U.S. produces less than 1% of the global supply of rare earths, making it particularly susceptible to supply disruptions.

The ramifications of these export restrictions extend beyond the defense sector. Industries reliant on rare earths, including automotive and technology, are bracing for potential supply shortages. Analysts are warning that the current restrictions may lead to increased prices for consumer goods that depend on these materials, including electric vehicles and medical devices.

Matthias Rüth, Managing Director of Tradium, a key supplier of rare earths in Germany, expressed concern over the potential for supply bottlenecks. He recalled past instances where China halted exports, causing prices to soar and highlighting the global dependence on Chinese resources. Rüth indicated that the current market is already showing signs of distress, with many companies unable to secure reliable pricing for rare earth materials.

In light of these developments, there is a growing push for alternative sources of rare earths outside of China. Companies like NioCorp and U.S. Critical Materials are actively exploring rare earth deposits in Nebraska and Montana, seeking to reduce U.S. dependence on Chinese imports. Meanwhile, the European Union is also taking steps to secure its own supply of critical raw materials, recognizing the significant risks posed by reliance on a single source.

As the geopolitical landscape continues to shift, the future of trade relations between China, South Korea, and the United States remains uncertain. The tightening of China's export policies may compel countries and companies to rethink their supply chains and seek diversification to mitigate risks associated with potential disruptions.

In conclusion, the ongoing trade war and China's recent export restrictions on rare earth elements underscore the fragility of global supply chains and the critical need for countries to develop independent sources of essential materials. As industries brace for potential impacts, the quest for alternative supply sources will likely shape the future of technology and defense sectors around the world.