In a significant escalation of the ongoing trade war between the United States and China, the Chinese government has ordered its airlines to halt all deliveries of Boeing aircraft. This decision, announced on April 15, 2025, marks a sharp retaliation against President Donald Trump’s recent tariff increases on Chinese imports, which now reach up to 145%. Beijing has responded with its own tariffs of 125% on American goods, further intensifying the economic conflict between the world’s two largest economies.

According to a report from Bloomberg News, the directive from Beijing not only blocks deliveries of already-manufactured Boeing jets but also freezes the purchase of U.S.-made aviation equipment and spare parts. This move could have dire consequences for Boeing, which has long relied on the Chinese market for a substantial share of its orders and deliveries.

As the trade tensions escalated, President Trump took to social media, stating that China “just reneged on the big Boeing deal,” indicating that the country would “not take possession” of aircraft it had previously committed to purchasing. This development comes at a particularly challenging time for Boeing, which is still recovering from the fallout of the 737 MAX crisis—a situation that has already strained its relationship with Chinese regulators.

China has been a critical market for Boeing, with estimates suggesting that Chinese airlines are expected to purchase 8,830 new planes over the next 20 years. However, the recent trade policies have severely impacted Boeing's ability to compete in this lucrative market. The company has only managed to secure 28 orders from Chinese customers in the past six years, a stark contrast to the 122 planes ordered in 2017 and 2018.

The ban on Boeing deliveries could also lead to a significant financial impact on the company, which contributes an estimated $79 billion to the U.S. economy and supports approximately 1.6 million jobs, both directly and indirectly. Boeing employs nearly 150,000 workers in the United States and has been struggling financially, racking up $51 billion in operating losses since 2018.

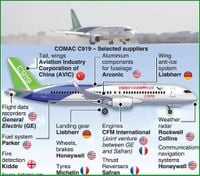

Furthermore, the halt on deliveries could grind operations to a halt for Chinese carriers that rely on Boeing jets, as these airlines may face challenges in sourcing necessary parts and systems from the U.S. The situation is further complicated by the fact that many of the components used in China's domestically produced aircraft, such as COMAC's C919 and C909 jets, are sourced from American suppliers.

Experts suggest that this move by China could inadvertently benefit Boeing's chief rival, Airbus, which may now capture a larger share of the Chinese market. Airbus already assembles its A320neo family at a plant in Tianjin, and the increased demand for its aircraft could help mitigate some of the losses Boeing is likely to face.

Additionally, the Chinese government is reportedly considering support measures for airlines operating leased Boeing aircraft, which now face increased operating costs due to the trade dispute. This could provide some relief to airlines caught in the crossfire of the escalating tariffs.

Despite the ongoing tensions, neither Boeing nor the Chinese Ministry of Foreign Affairs has officially confirmed Bloomberg's report. However, the implications of this directive are clear: the trade war is not only a political issue but also a significant economic challenge that could reshape the landscape of the global aerospace industry.

As the situation unfolds, analysts are closely monitoring how both countries will navigate this complex web of tariffs and trade restrictions. The stakes are high, and the outcome could have lasting effects on international trade relations, particularly in the aerospace sector.

In the broader context, the trade conflict has raised concerns about the potential for a prolonged economic downturn, with implications for jobs and industries across both nations. As companies like Boeing grapple with the fallout, the impact of these tariffs could extend far beyond the aerospace industry, affecting various sectors that rely on international trade.

The Chinese market has historically been a significant source of revenue for Boeing, and the ongoing trade war threatens to further isolate the company from this vital market. With Boeing's shares already falling by 1% in early trading following the announcement, investors are wary of the potential long-term consequences of this latest escalation in trade tensions.

Ultimately, the situation remains fluid, and the future of Boeing's operations in China is uncertain. As both nations continue to impose tariffs and retaliatory measures, the implications for global trade and the aerospace industry will be closely watched by economists, analysts, and industry leaders alike.