In a stark warning for British taxpayers, the Institute for Fiscal Studies (IFS) has indicated that Chancellor Rachel Reeves may resort to significant tax hikes this autumn as her economic plans face mounting scrutiny. The IFS's analysis suggests that the Chancellor's budgetary strategies may not hold up against the backdrop of a challenging economic landscape, particularly with the looming threat of tariffs imposed by the United States.

The IFS's director, Paul Johnson, highlighted that the Chancellor's spending plans leave little room for error, noting it is a "coin toss" whether Reeves can adhere to her fiscal targets. Johnson pointed out that extending the freeze on tax thresholds, currently set to expire in 2028, could serve as an "easy political win" for the Chancellor, potentially adding an extra £10 billion to the Treasury's coffers.

In a post-spring statement briefing held on March 27, 2025, the IFS also flagged the possibility of taxing lump sums withdrawn from pension pots as an attractive option for generating revenue. Johnson remarked that pensions might appear to be a "juicy" target for additional taxation, amidst concerns that the economic situation could deteriorate further.

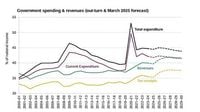

As the political climate heats up, particularly following Donald Trump's announcement of a 25% tariff on US car imports, the IFS cautioned that Reeves's budgetary headroom could be severely compromised. The Office for Budget Responsibility (OBR) has projected only a 54% chance that the UK will achieve a balanced budget by 2029-30, with the likelihood of the national debt declining even lower at 51%.

Despite these warnings, Chancellor Reeves has downplayed the prospect of imminent tax increases, asserting that her government is focused on fostering economic growth through various reforms. In interviews following the spring statement, she stated, "There are loads of things that this government are doing that are contributing to growth," emphasizing her commitment to avoid raising taxes on working individuals.

However, the Chancellor's assurances have not quelled concerns among analysts and opposition figures. The recent Techne UK tracker poll revealed a drop in Labour's support, falling from 27% to 25%, following Reeves's announcement of £5 billion in welfare cuts. Critics argue that these cuts disproportionately affect the poorest households, with the Resolution Foundation estimating that the welfare reforms could leave families £1,700 worse off on average.

Furthermore, the impact assessment from the Department for Work and Pensions (DWP) suggests that the number of individuals claiming personal independence payments could rise by over 750,000 in the next five years, indicating that the welfare system remains under significant strain.

In light of the economic challenges, Johnson warned that speculation around potential tax increases could lead to economic harm, as uncertainty looms over the government's fiscal strategy. He stated, "There is a good chance that economic and fiscal forecasts will deteriorate significantly between now and an autumn budget. If so, she will need to come back for more, which will likely mean raising taxes even further."

As the autumn budget approaches, the Chancellor faces mounting pressure from both the public and her party to address the growing economic crisis. Labour MPs have voiced their concerns, with some already indicating they will not support the current welfare reform package. Senior Labour MP Stella Creasy expressed her discontent, stating, "I hope that they are listening to the concerns that people have on the backbenches. I hope they are willing to countenance alternatives."

Meanwhile, the repercussions of Trump's tariff announcements are being felt across the UK economy. Richard Hughes, chairman of the OBR, has warned that the tariffs could wipe out the £10 billion headroom Reeves had created in her spring statement. Hughes noted that the potential for a global trade war could significantly impact the UK’s GDP, further complicating the Chancellor's fiscal position.

As the government grapples with the implications of these tariffs, the Chancellor's commitment to not raise income tax, VAT, or national insurance contributions, as outlined in Labour's manifesto, leaves her with limited options for generating additional revenue. Critics argue that this constraint may force Reeves to explore unpopular measures, such as a wealth tax or further cuts to welfare spending, to meet her fiscal targets.

In response to the growing discontent surrounding welfare cuts, Prime Minister Sir Keir Starmer has backed Reeves's assertion that the government’s reforms will not lead to increased poverty. However, the government's own impact assessment contradicts this claim, projecting that the cuts will push an additional 250,000 people, including 50,000 children, into poverty.

As the political landscape shifts and public sentiment grows increasingly critical, the Chancellor's ability to navigate these turbulent waters will be pivotal. The upcoming months will test her fiscal strategies and her government's resolve to maintain its commitments while addressing the pressing needs of the British populace.

In summary, the IFS's warnings serve as a clarion call for the government to reassess its economic policies and engage with the concerns of its constituents, as the potential for further tax hikes looms ever closer.