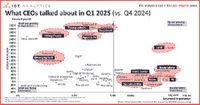

In the evolving landscape of business and economics, the early months of 2025 have been vividly characterized by a focus on tariffs, uncertainty, and AI. The latest report, "What CEOs Talked About in Q1 2025," from IoT Analytics highlights these three themes that dominated executive discussions during the first quarter of the year.

As the global economy navigates through fluctuations, the U.S. economy is facing dramatic changes following the new administration’s introduction of aggressive trade tariffs. These tariffs, introduced by President Trump within the first month of his second term, targeted not only traditional trading rivals like China but allies including Canada, Mexico, and the EU. This sweeping move resulted in retaliatory tariffs, provoking investor concerns about the health of the U.S. economy, which reflects a broader global concern. According to the Organisation for Economic Co-operation and Development (OECD), the global GDP growth projection was revised from 3.3% to 3.1% for 2025, while the U.S. forecast dropped from 2.4% to 2.2%.

The implications of such tariffs have been profound, sparking a noteworthy increase in discussions around tariffs during corporate earnings calls. Mentions of tariffs soared by 190% from the previous quarter, with 43% of calls addressing the subject—an unprecedented peak post-2019. Many CEOs expressed grave concerns over how these tariffs would elevate prices in the U.S. market, with discussions on supply chain adjustments becoming paramount.

Jeff Clarke, COO of Dell Technologies, remarked, “And whatever tariff we cannot mitigate, we view that as an input cost. And as our input costs go up, it may require us to adjust prices.” Similarly, Christian Rothe, CFO of Rockwell Inc., described current strategies: “We are swapping those out, moving the production for non-U.S. customers outside the U.S. in order to create capacity to manufacture production for U.S. customers inside the U.S.”

Conversely, some companies anticipate potential benefits from the tariffs, viewing them as an opportunity to gain a competitive edge in markets where they already have a local manufacturing presence. While some CEOs are reconsidering their operations amid tariff uncertainty, others found new strategies to leverage these challenges to their advantage.

Alongside tariff discussions, the theme of uncertainty emerged emphatically in conversations among executives. Uncertainty climbed among CEOs by 49% quarter-over-quarter, appearing in 35% of earnings calls. CEOs voiced concerns over the unpredictability of the economic landscape, interest rates, and military alliances. This surge in uncertainty reflects a broader sentiment of unease that has made long-term planning and investment decisions increasingly cumbersome.

As noted by Diego De Giorgi, CFO of Standard Chartered PLC, “The level of uncertainty out there is higher than it was before.” Jamie Dimon, CEO of JPMorgan Chase & Co., added further insight into operational hesitations as he stated, “Some pockets in some industries might be more cautious than they otherwise would be about what they’re executing in the near term.”

Amid these ongoing challenges, a significantly rising topic on the corporate agenda is artificial intelligence, particularly agentic AI, which refers to systems designed to operate autonomously. This subject was mentioned in 39% of earnings calls, marking a 12% increase. However, agentic AI discussions notably surged by 275% quarter-over-quarter, comprising 2.2% of calls.

Steve Hasker, CEO of Thomson Reuters Corporation, expressed enthusiasm, stating, “As we free up our customers from manual low-value tasks, we plan to bring additional advisory capabilities, starting with tax planning later this year through our agentic AI assistant.” Jensen Huang, CEO of NVIDIA, noted, “That whole part of using agentic AI to revolutionize the way we work inside companies, that’s just starting.”

Amid economic constraints, companies recognize the urgent need to invest in AI technologies to drive productivity. However, shifts in workforce dynamics are evident, with conversations surrounding recruiting declining by 8%. Moreover, mentions of hiring freezes skyrocketed by 286% in the same time frame. These shifts indicate evolving corporate attitudes toward future workforce expansion, as some companies appear reticent about hiring amid uncertainty.

The fashion industry is also grappling with these challenges, as outlined during the American Apparel and Footwear Association’s summit held earlier this month, where the overarching theme was "Trust & Transformation." Leaders in the fashion sector are attempting to navigate the constantly evolving trade landscape shaped by new tariffs and the U.S. administration's unpredictable policies. Stephen Lamar, president of the AAFA, described the current environment as “a curve on top of a curve,” emphasizing the need for negotiation strategies that prioritize both smart sourcing and responsible manufacturing.

In addition to tariffs, environmental concerns are prompting shifts in the fashion industry as regulations evolve. The extended producer responsibility program in California, passed in 2024, shifts the responsibility of product lifecycle management onto producers. This initiative presents an opportunity for fashion brands to enhance sustainability efforts and align their strategies with evolving consumer expectations.

The discussion about consumer behavior in recent years indicates a shift where spending patterns are moving away from apparel to travel and experiences. Tapestry CEO Joanne Crevoiserat highlighted the importance of targeting younger consumers, particularly Generation Z, who often seek brands that enhance their personal brand on social media platforms. “If the customer never changed, they wouldn’t need our brands,” she noted, emphasizing the need for brands to innovate constantly.

Overall, the landscape of business in early 2025 is marked by uncertainty and opportunity. CEOs are tasked not only with navigating current challenges but with positioning their organizations for future success in a rapidly changing market. Strategic decision-making amidst tariffs, evolving consumer preferences, and advancing technologies like AI will likely define corporate trajectories in the coming years.