The Canadian labor market faced considerable strain in February 2025, marking the slowest pace of job creation observed since early 2022. According to Statistics Canada, the country experienced only 1,100 new jobs, which significantly underwhelmed economists who had anticipated about 20,000 new positions to be created. This lack of growth maintained the unemployment rate at 6.6%, indicating stability, but not without concern.

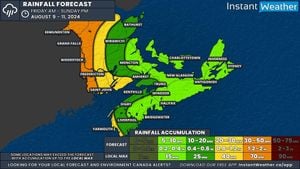

February was characterized by significant weather challenges, as major snowstorms swept through eastern and central Canada, causing over 429,000 Canadians to lose work hours. These harsh conditions amplified the impacts already felt within the labor market, where the overall increase chalked up masks troubling undercurrents.

Brendon Bernard, principal economist at employment site Indeed, reflected on the contrasting job situation: "There are potential problems for the labor market, but that's not what we saw in February." The modest gains were consistent, especially within the wholesale and retail sectors, which saw substantial job creation. Meanwhile, notable losses of around 4,800 positions occurred within the manufacturing industry—a sector which had previously led job additions earlier this year.

While the wholesale and retail trade sectors shone with the most job creation, the services sector faced declining employment. Significant cuts were noted particularly within professional, scientific, and technical services, alongside transportation and warehousing. "The storm is not raging, but the clouds are still, I think, on the horizon," Bernard noted, emphasizing the fragility of the current employment climate.

Economically, the Canadian population saw minimal growth, with only 47,000 people aged 15 and older added—less than half the growth seen during February 2024. The overall lost full-time employment was compensated partially by the gain of 20,800 part-time jobs. Researchers observed the growth of hours worked plummeting by 1.3%—the steepest decline since April 2022—suggesting those counting on stable earnings might find themselves at risk.

The unemployment saga played out across the provinces, with Quebec recording stability for the third month running and its unemployment rate dropping to 5.3%—making it the lowest among the ten provinces. The province seems shielded from the broader malaise gripping the nation as its economy held firm, even smiling down upon the stormy weather impacting labor nationwide.

The imminent decisions from the Bank of Canada come upon this complicated backdrop. The bank will be meeting on March 12 to discuss interest rates. James Orlando, TD Bank’s director and chief economist, commented on the role of weather, stating, "Luckily, the Canadian labor market entered the current tariff crisis on solid footing," maintaining optimism against the prospects of impending U.S. tariffs slated to roll out soon.

Some economists, including Andrew Grantham of CIBC, speculate this data should influence the Bank of Canada’s next moves. Given the plateaus observed, Grantham indicated, "Given the upcoming trade war impacts, the Bank of Canada may lean toward another 25 basis point cut next week." These impending tariffs present significant uncertainty, particularly for manufacturing and export sectors, which might signal dampening economic activity.

The repercussions of the delaying economic momentum ask for all eyes to be focused on the subsequent weeks as the Canadian economy prepares for any fallout related to U.S. actions. Current forecasts provide varying possibilities, with RBC noting the bank's precarious position might lean anywhere from holding steady to minor adjustments based upon real-time evaluations leading up to their decision.

To sum up, February's employment figures give rise to caution among economists and policymakers alike. With stability measured against stormy circumstances and geopolitical pressures, the next steps taken by the Bank of Canada will be closely monitored as stakeholders await how tariffs and weather contribute to employment outcomes moving forward.