Canada's job market remains on shaky ground as new figures paint a disconcerting picture of employment stability heading toward the Bank of Canada's next key interest rate decision. February 2025 saw the Canadian economy add only 1,100 jobs, markedly below economists' optimistic expectations of 20,000 job gains, according to Statistics Canada. The unemployment rate has held steady at 6.6 percent, and the overall employment rate remained unchanged at 61.1 percent.

This stagnation in job growth has led to increased speculation surrounding the Bank of Canada's upcoming meeting on March 12, 2025, where many analysts anticipate interest rates will be cut, possibly by 25 basis points. Financial markets now suggest the possibility of this cut skyrocketed to 85 percent from just 50 percent the previous week, as per the insights shared by David Rosenberg, president of Rosenberg Research & Associates Inc., reported by the Financial Post.

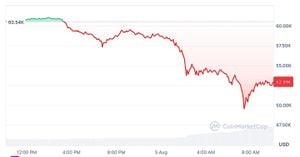

Despite Canada experiencing surprisingly strong GDP growth of 2.6% during the fourth quarter of the previous year, concerns over trade conflicts with the United States continue to loom large. On March 4, US President Donald Trump implemented tariffs on several Canadian imports, casting shadows of uncertainty on what has been seen as Canada's fragile economic recovery. Governor Tiff Macklem of the Bank of Canada warned, “The economic consequences of a protracted trade conflict would be severe,” underscoring the risks borne from reduced exports, which could potentially decline by around 8.5% due to tariffs.

Despite some sectors seeing job growth, such as retail and wholesale trade, which saw 51,000 new positions, certain areas like professional services and manufacturing displayed concerning declines. The manufacturing industry, which had seen modest growth recently, shed 4,800 jobs in February. Oddly enough, Ontario reported adding 10,800 manufacturing jobs, providing a regional counterpoint to broader losses.

Another layer of complexity was added by severe winter weather, which led to 429,000 workers losing hours due to snowstorms across Central and Eastern Canada. This contributed to total hours worked falling by 1.3%, marking the largest monthly decline since April 2022. Nathan Janzen, assistant chief economist at RBC, pointed out how the combination of weaker job figures and persistent trade uncertainties is likely to push the Bank of Canada toward cutting rates to stimulate economic activity.

Analysts predict the upcoming rates will create more support for the labor market as businesses grapple with persistent tariff uncertainties and other market fluctuations. There is division among economists; 17 out of 25 believe the rate cut is unavoidable, whereas eight expect no significant changes.

Despite its previous potential, the Canadian dollar is facing downside risks. The currency has been trading at around 1.43 to 1.44 against the US dollar, capturing some risk premium linked to the US-Canada trade dynamics. The uncertainty surrounding US tariffs directly impacts Canadian goods, especially as Canada has already introduced tariffs on CAD$30 billion worth of US imports, which are projected to raise prices on everyday products such as orange juice and kitchen appliances.

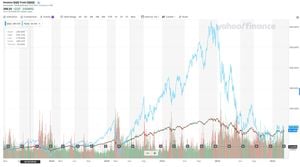

Andrew Grantham of CIBC Capital Markets suggested these economic pressures—coupled with concerns over immigration control impacting labor—indicate the necessity for the Bank of Canada to employ another round of rate cuts. The Canadian economy had demonstrated sustained growth through the previous years, with growth at 1.5% shown to surpass the Bank of Canada’s forecast. Still, as economic conditions shift, and sectors fluctuate, the path forward remains fraught with uncertainty.

With markets fully pricing the anticipation of a 25bp cut next week, observers will be closely monitoring the situation for any deviations based on last-minute developments. The influence of the Bank of Canada and its monetary policy actions will be tested, as any unexpected decisions could shake the already cautious market sentiment.

Historically, the Canadian economy is significantly influenced by its southern neighbor, the United States, with more than three-quarters of Canadian exports headed south of the border. This interdependence often leads to sharp reactions from the Canadian market to US policy changes, particularly those affecting trade. Given the high stakes of the forthcoming decisions, both the Bank of Canada and Canadian businesses must navigate these choppy waters deftly.

With the Bank of Canada set to announce its interest rate decision on March 12, all eyes will be on the committee, with many hopeful for signs of monetary easing to mitigate these economic pressures amid unpredictable conditions.