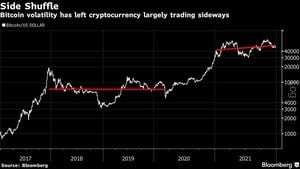

Bitcoin, the leading cryptocurrency, has been struggling to surpass the significant resistance level of $100,000, with its price fluctuated around $95,500 amid market turbulence stemming from recent events.

Despite these challenges, there are signs of potential recovery as over 200,000 new Bitcoin wallets were created this past weekend. This surge indicates increased interest among traders following the hack of the Bybit exchange, which saw hackers steal approximately $1.5 billion. This event has cast shadows over market confidence, highlighting the importance of safely storing digital currency.

The hack, described by many as the most significant breach in cryptocurrency history, has left investors jittery and reevaluated their strategies. Following the attack, Bitcoin experienced a minor dip to around $95,000 before stabilizing, fueling hopes among traders of breaking the $100,000 threshold once again. Some analysts remain optimistic, citing strong buying opportunities at this price, especially since 2.76 million addresses hold about 2.1 million BTC within the $95,830 to $98,700 range, creating solid support.

Meanwhile, Michael Saylor, the founder and executive chairman of company Strategy, has aggressively expanded the firm’s Bitcoin holdings, prompting discussions about its potential to approach 500,000 BTC. Strategy recently invested $1.99 billion at this growth stage, acquiring the digital asset at $97,514 apiece. Saylor’s actions have turned the company, initially known for its software business, symbolically associated with Bitcoin, becoming one of the pioneers of corporate cryptocurrency adoption.

This aggressive accumulation reflects broader trends, as more companies begin to see Bitcoin as protection against inflation and shifts away from traditional investments. The current market conditions, with these impending large-scale purchases, pose the question: is Bitcoin primed for another bull run?

Even as Bitcoin struggles, some cryptocurrencies like Ethereum show resilience, albeit under different pressures. Despite recent challenges leading to losses due to the Bybit hack, analysis suggests Ethereum might be recovering, hinting at positive momentum. Ethereum fell 2.8% recently yet has shown greater strength against external shocks than initially expected.

Traders caution, though, as macroeconomic pressures, including inflation worries and regulatory uncertainties, loom over the market dynamics. Upcoming releases of key economic indicators, particularly U.S. inflation metrics like the PCE Price Index, could bring more clarity about how the Federal Reserve's policies could influence risk assets, including cryptocurrencies.

Meanwhile, there’s notable caution among investors; many are waiting on the sidelines to see how these events pan out. The volatility characterized by the recent onslaught of bad news serves as both a warning and opportunity for astute traders. The sentiment might shift dramatically, based on forthcoming economic data.

This unpredictability, combined with recent selling pressures, particularly among altcoins like XRP and Solana, has raised substantial concerns within the market. XRP, facing legal challenges with the SEC, remains under pressure as it battles to maintain its value after significant highs.

To sum up, the road to $100,000 is not just about breaking resistance levels; it’s about the broader contextual factors influencing market behavior. From significant corporate purchases to the psychological impact of high-profile hacks, the narrative surrounding Bitcoin continues to evolve, keeping traders engaged and on alert.

While some investors might view the challenges as bearish signals, others see it as merely the nature of cryptocurrency trading—the highs and lows, the fears and hopes. With the forthcoming indicators and current support levels, many analysts remain cautiously optimistic about Bitcoin's future.

For now, Bitcoin remains at the forefront of financial innovation, with its value acting as both beacon and battleground for the future of decentralized finance.