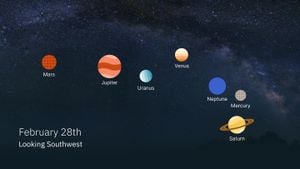

Bitcoin has recently faced significant volatility, struggling to maintain its position as it dropped below $85,000 amid growing market concerns. On February 28, 2025, the world’s largest cryptocurrency fell to $82,000, marking its lowest price since mid-November 2024. This downward trend reflects broader anxiety not just about Bitcoin, but across the entire cryptocurrency sector, which has seen over $1 trillion wiped off its total valuation within just three months. Analysts are pointing to several factors at play, including social and economic aspects stemming from market reactions to tariffs proposed by U.S. President Donald Trump.

The abrupt pressuring of Bitcoin follows its peak of $109,350 earlier this year. Currently, with market caps hovering around $1.68 trillion, the trading atmosphere indicates strong bearish sentiments as many investors are spooked by financial instability and are opting for more secure investments. "The crypto market has entered a bear phase with Bitcoin declining over 20 per cent from its January peak of $109,350 to an intraday low of $83,740," said Avinash Shekhar, co-founder and CEO of Pi42.

The latest decline mainly arises from the perceived threat of proposed tariffs by Trump, which include substantial 25 percent hikes on imports from the European Union. This announcement has prompted worries of inflation and potential economic slowdowns. Sonu Jain, the chief risk and compliance officer of 9Point Capital, noted, "Bitcoin’s drop below $85,000 reflects broader market movements where declines in tech equities—particularly on the Nasdaq—indicate risk-off sentiment." The linkage between Bitcoin’s performance and the traditional equity markets has grown increasingly evident; as fears grip Wall Street, so too does it translate drastically to Bitcoin prices.

Adding to this downturn is the rising number of ETF outflows, with institutions removing billions as market volatility increases. "ETF outflows and Trump’s EU tariff threats have pressured the market; BTC can experience a potential drop to $74,000," offered Shekhar. This sell-off of Bitcoin and related assets has resulted not only from speculators and day traders eager to mitigate their losses but also from institutional stake holders who are reevaluing their positions. Last week alone, institutions sold off approximately 79,300 BTC, resulting in massive downgrades across the board.

Market analysts collectively agree on the precarious nature of cryptocurrencies at present. "A rebound in Bitcoin will likely depend on a broader return of risk appetite and institutional support across the board, as volatility remains elevated for now," reassured Jain. Various cryptocurrencies besides Bitcoin also took hard hits; Ethereum dropped to $2,300, illustrating the systematic uncertainty prevalent among digital assets and triggering broader fears surrounding altcoin markets.

Despite the persistent negativity, some analysts are choosing to hold firm on their faith. Thangapandi Durai, CEO at Koinpark, asserted, "Bitcoin’s drop below $85,000 is driven by short-term market pressures, including ETF sell-offs and tariff threats. Yet, as regulatory clarity improves, and with the upcoming Bitcoin halving, we expect market sentiment to stabilize." This alludes to the cyclical nature of the cryptocurrency industry, which has historically recovered from market corrections.

With the recent aggressive liquidations and flash crashes experienced over the past days, the outlook remains turbulent. Nevertheless, fundamental signals indicate potential accumulation by long-term holders, as they appear undeterred by short-term fluctuations. Analysts are cautiously optimistic but acknowledge the high volatility surrounding the current trading climate.

Although many are perplexed by the strong market reactions to events seemingly peripheral to Bitcoin's intrinsic value, the evidence supports the notion of Bitcoin as not merely a decentralized currency but increasingly aligned with the volatile movements of Wall Street investments. The general consensus from experts indicates the forthcoming weeks will be pivotal for Bitcoin, as it could either reclaim previous heights or plunge to previously untested lows.

The current performance suggests Bitcoin is at the mercy of geopolitical moves, trader sentiment, and broader economic conditions more than ever before.