Bismuth, a niche metal utilized in industries spanning from paints to defense applications, has seen its price skyrocket by nearly 500% since early February 2025. This dramatic rise in cost can be traced back to China’s implementation of stringent export controls, enacted in reaction to trade actions initiated by U.S. President Donald Trump.

The catalyst for these controls was Trump’s announcement in early February of a 10% import tariff on a range of Chinese goods. In response, China added bismuth to a list of five controlled export materials. This strategic move resulted in bismuth exports plummeting by more than half in February compared to last year, tightening global supply and pushing prices from a mere $6 a pound before February 4 to nearly $35 per pound by mid-March.

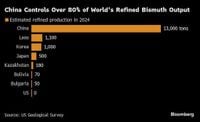

The implications of rising bismuth prices extend beyond market fluctuations; they underscore the evolving dynamics of U.S.-China relations as both countries grapple with escalating geopolitical tensions. China currently produces approximately 80% of the world's refined bismuth, leading to a heavy dependence of the United States on Chinese supplies. Since 2013, the U.S. has not produced any bismuth domestically, relying on China for about two-thirds of its consumption. This reliance has raised alarms about national security within the U.S., prompting Trump to invoke emergency powers to boost domestic production of critical minerals.

During a recent interview, Robin Goad, the CEO of Fortune Minerals, raised caution about the potential long-term consequences of China’s export restrictions. “As the major supplier of bismuth to the world, China is effectively shooting itself in the foot with export restrictions causing huge spikes in the price that may incentivize customers to look for alternative materials,” he commented. Goad added that “this is not good for the market over the longer term.”

Bismuth is a critical metal that finds uses in various sectors, including automotive coatings, pharmaceuticals, and low-temperature alloys. The material’s versatility has led to its inclusion in the growing list of metals under heightened scrutiny by the Chinese government regarding export approval. Other materials facing similar restrictions include tungsten, molybdenum, indium, and tellurium.

As a result of export controls and a surge in bismuth pricing, many traders are holding back stock from the market, further applying upward pressure on prices. Recent data from China’s customs administration reveal that bismuth exports fell to 458 tons in February 2025— a stark contrast to the monthly average of the previous year, which was over 1000 tons.

Furthermore, China's domestic market has been impacted as well, with prices for domestic bismuth ingots doubling since the imposition of export restrictions. This set of circumstances has led to notable growth for companies operating in the mining sector, including Zhuzhou Smelter Group Co., which reported a 24% rise in stock value in March, juxtaposed with a meager increase in the broader Shanghai stock market.

Amid these developments, the question arises: how will the U.S. and other nations respond to the increasing price of bismuth and similar strategic materials? As global demand for these metals grows and trade tensions persist, the risk of producing alternative materials becomes ever more likely. The U.S. may ramp up efforts to explore domestic sources or develop substitutes to reduce reliance on China.

Analysts suggest that while the current spike in bismuth pricing serves as a wake-up call, the long-term strategy must include fostering reliable and resilient supply chains. The potential for an essential metal like bismuth to fluctuate wildly emphasizes the fragility of resources that intersect with national interests.

In conclusion, the volatile landscape of bismuth pricing likely reflects broader geopolitical dynamics as countries navigate complex supply chains amidst growing restrictions and trade wars. This developing situation points to the urgency for nations to rethink their resource strategies to ensure stability and sustainability in critical raw materials.