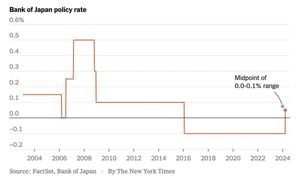

On January 24, 2025, the Bank of Japan (BoJ) made waves by announcing its first interest rate hike since 2008 during its latest monetary policy meeting, raising the short-term rate target by 25 basis points from 0.25% to 0.50%. This move was largely anticipated by market analysts, driven by persistent inflationary pressures bracketed by signs of economic recovery.

Data leading up to the decision indicated mounting inflation, with Japan's core consumer price index rising to 3.0% year-on-year in December, exceeding the BoJ’s 2% target and indicating the highest annual pace seen since August 2023. Economists have pointed out the significant contributors to this inflation surge include the rolling back of government subsidies for utility bills and persistently high import prices linked to the weak yen, which continue to keep costs elevated.

Aside from the headline inflation, the BoJ revealed its broader economic sentiment through its quarterly outlook, forecasting core inflation should hover around the 2% mark for fiscal years 2024 and 2025. Expectations for wage increases were also noted as firms are reportedly gearing up for substantial pay hikes during upcoming negotiations, underlining the economy’s gradual recovery.

According to Reuters, 18 out of 19 economists surveyed anticipated the BoJ would proceed with this hike, which constituted the most substantial alteration to its monetary policy stance since the bank had held steady over the past three meetings.

Following the announcement, the USD/JPY currency pair reacted swiftly. Initial trading saw the dollar dip against the yen as it tested levels around 156.50, underscoring the volatility associated with central bank communications. Market analysts suggested this response indicates investor expectations surrounding the possibility of more aggressive monetary policy from the BoJ as inflation rates continue to challenge the old norms.

Bank of Japan Governor Kazuo Ueda addressed the press detailing the board’s unanimous decision aside from one dissenting voice, which cautioned against altering the current guideline without more concrete evidence of sustainable economic growth. This dissent highlights the delicate balance the central bank is trying to navigate between fueling growth and controlling inflation.

Beyond immediate currency reactions, the impact of the BoJ's decision is being watched closely by global markets. The interconnection between Japan's monetary policies and global economic trends was emphasized during the World Economic Forum where discussions on market stabilizations put emphasis on cooperative central bank strategies.

The hike not only signals Japan's gradual exit from ultra-loose monetary strategies but also resonates on the international stage where the Fed's policies and interest rates are being recalibrated post-pandemic. The anticipated changes across the board add layers of complexity to exchange rates like USD/JPY as investors refine their strategies amid this new financial climate.

Ueda hinted at continued vigilance during his announcement, reminding analysts and investors alike of the BoJ's commitment to respond flexibly as economic conditions evolve. Notably, the potential for future rate hikes hinges on employment outcomes and inflation persistence, which Ueda suggested are likely influenced by seasonal wage negotiations the Japanese economy is about to face.

This decision by the Bank of Japan is far-reaching; it is symptomatic of larger economic trends affecting many developed nations where central banks wrestle with the dual challenges of fostering economic growth amid inflation fears.

The broader economic atmosphere is also punctuated by international reactions to U.S. President Donald Trump's recent calls for reduced interest rates, pitching the BoJ's decision slightly against the backdrop of competing global economic policies. This notion resonates with the uncertainty surrounding currency valuations as global economies strive for equilibrium.

Going forward, market participants are urged to remain attentive to signals from BoJ officials and any shifts within its outlined monetary policy as Japan endeavors to renew its financial strategies amid rising inflation concerns. The BoJ's next moves will be pivotal as Japan seeks to establish itself firmly against the backdrop of fluctuated global markets.