Australia's trade relations faced significant challenges today as US President Trump's administration imposed a stark 25% tariff on all steel and aluminium imports, including those from Australia. Effective at 3 PM on March 12, 2025, this move has been met with sharp criticism from Australian leaders, with Prime Minister Anthony Albanese describing it as "unjustified and not the way friends and allies should be treated." Foreign Minister Penny Wong echoed similar sentiments, signaling concerns over the broader ramifications of such protectionist measures.

The economic impact on Australia immediately appears modest, with less than A$1 billion of steel and aluminium exported to the US in 2023, according to UN Comtrade data. Yet, the consequences extend beyond mere dollars and cents, fundamentally challenging Australia’s trade strategy within the shifting sands of global market dynamics.

Prior to this development, Australia had held hopes of securing exemption from the tariffs, as it had during the previous Trump presidency. Unfortunately for Australian producers, the current administration has shown no willingness to negotiate, shifting the analysis of potential outcomes from hypothetical to immediate. For Bluescope Steel, Australia’s largest exporter of steel to the US, the consequences of the tariff will be felt directly. Annual shipments of around 300,000 tonnes of semi-processed steel will now be weighed down by these tariffs, with the company having to navigate increasing production costs.

Bluescope Steel operates plants not only in Australia but also maintains significant operations in Ohio, employing around 4,000 workers. While there are short-term financial benefits for the Ohio plant due to higher prices on Canadian imports, the long-term perspective raises concerns about sustainability amid volatile market conditions.

But it’s not just the steel sector at risk. Exporters of high-tech engines, aircraft parts, and machinery—more than 40% of which is sent to the US—face uncertainties as these tariffs create ripples throughout the supply chain. Australia’s services sector exports approximately $6.2 billion worth of various services to the US yearly, impacting additional businesses caught up by these new restrictions.

With Australia’s economy largely dependent on diversified markets, the current tariffs serve as a wake-up call for many exporters. The specter of potential trade wars hints at heightened anxiety among the 12,000 Australian companies engaged with the US, who are now forced to ponder the future state of their trading environment. Questions loom large: What will the next target be?

Interestingly, the tariffs may not only influence Australian exports. There’s concern about how countries like China may leverage this situation to boost exports of cheaper steel and aluminium to Australia, putting local manufacturers under additional pressure and potentially instigated calls for anti-dumping investigations.

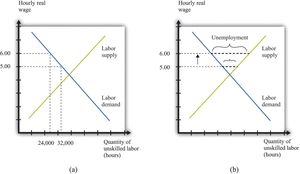

Despite these developments, Australia remains committed to refraining from imposing reciprocal tariffs on the US. Albanese’s government has recognized the counterproductive nature of such actions, believing they would escalate rather than resolve tensions. Experts warn of the additional repercussions tariffs could have on the US market itself, potentially leading to higher costs for consumers reliant on imported goods, and resulting pressures on domestic industries using these materials.

At the core of this issue lies the complex relationship Australia shares with the US. While historically viewed as close allies sharing mutual interests, the current tariff situation has spurred questions over the efficacy of this partnership. Polling data from the Lowy Institute highlights growing disenchantment, with 92% of Australians deeming US political instability as "important" or "critical" to their own national interests.

Reflecting on the significance of these tariffs, experts suggest they could become, paradoxically, 'an own goal' for the US. With rising prices of goods compounded by the tariffs, US consumers may bear the brunt of these economic strategies. The ripple effects extend beyond immediate tariffs, signaling possible long-term strain on relations and strategic cooperation.

Negotiations on existing security agreements and the significant $3 billion payment Australia is set to render to US shipyards bring the trust factor between both nations under scrutiny. The expectation of reciprocity seems to have waned as the tariffs test Australia’s diplomatic acumen, forcing the nation to rethink its strategic balance across security and economic interests.

Now is the time for Australia to embrace market diversification seriously, steering clear of over-reliance on any single trading partner. The shakes within the US market showcase the urgency of strengthening trade ties with other nations and establishing long-term mutually beneficial agreements necessary for leveraging economic stability.

Australia’s efforts will also need to focus on constructive collaborations, particularly through global platforms such as the World Trade Organization (WTO). Proactive discussions on managing anti-dumping claims could yield pathways toward smoothing over the global trade transition we are currently observing.

With these tariffs standing as indicators of growing isolationist trends within US trade policy, Australia must greenlight cooperative strategies both locally and internationally to navigate these turbulent times effectively. It is evident; tariffs are neither merely taxes nor tools alone. They are powerful reminders of the growing impacts of economic nationalism and market isolation, with the imperative for Australia to safeguard its own interests without resorting to knee-jerk reactions.