Asian financial markets opened sharply lower on Monday, April 7, 2025, as a global sell-off intensified in the wake of U.S. President Donald Trump's sweeping tariff announcements. Investors are grappling with rising fears of a significant economic downturn as retaliatory measures from China further escalate the situation.

Japan's Nikkei 225 index plunged nearly 8% shortly after the market opened, hitting its lowest levels since October 2023. By midday, it was down 6% at 31,758.28. The broader TOPIX index also slid more than 8%. Meanwhile, South Korea's Kospi fell by 4.1% to 2,363.82, and Australia's S&P/ASX 200 dropped over 6% to reach a one-year low. Hong Kong's Hang Seng index experienced a staggering drop of 10%, while the Shanghai Composite and Shenzhen markets fell by 6% and 8%, respectively. Taiwan's market saw a historic decline of 9.8%, with shares in Taiwan Semiconductor Manufacturing Company suspended after hitting the 10% limit.

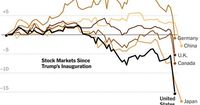

This turmoil follows a dismal trading session on Wall Street last Friday, where major U.S. indexes plummeted. The S&P 500 fell by 6%, the Dow Jones Industrial Average dropped 5.5%, and the Nasdaq composite lost 5.8%. The losses over the two days amounted to a staggering $5 trillion in market value, marking the worst two-day decline for the S&P 500 since the onset of the COVID-19 pandemic.

The catalyst for this market chaos was Trump's announcement on April 2, 2025, imposing a blanket 10% tariff on all imports and targeted levies of up to 49% on certain countries. These tariffs took effect on Saturday, April 5, and have sent shockwaves through global markets. China retaliated by announcing a sweeping 34% tariff on a wide range of U.S. goods, including agricultural products, energy commodities, and key tech components, set to begin on April 10.

In response to the escalating trade war, President Trump stated on April 6 that he would not ease tariffs unless other nations "pay us a lot of money." He dismissed concerns about inflation, suggesting that the economic pain was necessary to rectify trade imbalances. Trump’s administration has faced criticism for potentially igniting a global recession, with analysts warning that the tariffs could chill consumer spending and hurt economic growth.

As the situation worsens, global markets are bracing for further volatility. Stock futures in the U.S. indicated continued weakness, with Nasdaq futures shedding 5% and futures for the S&P 500 and Dow Jones each sinking more than 4%. The S&P 500 has now declined nearly 14% since the announcement of the tariffs, while the Nasdaq has fallen close to 16%, officially entering bear market territory.

In Asia, the ramifications of Trump's tariffs are particularly concerning. Many countries in the region, including Japan and South Korea, rely heavily on exports to the U.S. and could be significantly impacted by reduced demand. Japan's Prime Minister Shigeru Ishiba has expressed intentions to visit the U.S. to discuss the tariffs, emphasizing the need for negotiation rather than retaliation.

Despite the dire circumstances, some analysts remain cautiously optimistic. They believe that Trump may eventually negotiate with other countries to ease tariffs in exchange for concessions, which could stabilize markets. However, the risk remains that he could impose additional tariffs or retaliate against countries that respond with their own measures.

As the global economy teeters on the brink, many are left wondering how long the impacts of these tariffs will last and what the long-term consequences will be. The Federal Reserve may intervene by cutting interest rates to cushion the blow, but concerns about inflation persist. Fed Chair Jerome Powell noted that while lower rates could encourage spending, they might also fuel inflationary pressures.

While some investors hold onto hope that the economy can withstand the shock, the reality is that the trade war's fallout is already being felt across various sectors. Major companies have begun warning consumers of potential price increases on everyday goods, and some auto manufacturers have paused production overseas due to the uncertainty.

The unfolding situation is a stark reminder of how interconnected the global economy is and how quickly things can change. With tensions running high and no clear resolution in sight, markets are likely to remain volatile as investors navigate this new landscape. As analysts continue to assess the damage, the potential for a recession looms larger with each passing day.

In conclusion, the ramifications of Trump's tariffs are reverberating throughout the global economy, leaving investors and consumers alike anxious about the future. The next few weeks will be critical as countries respond and negotiations unfold, determining the trajectory of both the markets and the broader economy.