Apple Inc. is facing its steepest decline since 2022, with its stock price plunging more than 5% on Monday, March 10, 2025, amid broader market turmoil and concerns over delayed product features.

Jim Cramer, the prominent investor and television personality, cautioned against buying the dip as he examined the recent market dynamics. "I see no reason to buy it whatsoever. Let them take [the stock] down. I know a lot of shorts, and I know they're just going to press their bet," he stated during CNBC's Morning Meeting.

The drop follows disconcerting news from Citi analysts, who recently revised their iPhone sales estimates for 2025 and 2026, primarily due to delays associated with artificial intelligence rollout for Apple's virtual assistant, Siri. On March 7, Apple confirmed it does not expect to deliver new Siri features—previously anticipated to arrive by April—until at least 2026, disappointing expectations for an updated Siri with advanced capabilities like on-screen awareness and deep app integration.

Despite the setback, Citi analysts retained their "buy" rating on Apple's stock, reassessing their price target upward to $275, which exceeds the consensus target of $255. The analysts suggest this delay poses challenges for iPhone sales, especially as they predicted these advanced Siri features could have been key catalysts for increasing sales this year, particularly for the new iPhone 16.

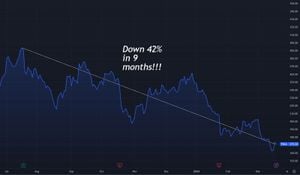

Interestingly, the stock has been on shaky ground even before this news. Year-to-date, Apple has seen its stock price drop 10%, compared to the S&P 500, which declined 4% during the same period. The tech-heavy Nasdaq index also reacted negatively, hitting its lowest levels since last September, largely driven down by stocks like Apple.

According to Cramer, investors should focus first on the company’s fundamentals rather than the stock's immediate fluctuational responses. He emphasized, "People are missing the whole boat. They should realize the service revenue stream is fantastic as well." This revenue stream, which includes subscriptions for Apple Music, iCloud, and the App Store, underlines Apple's financial health aside from its hard product sales.

Further complicate matters for Apple are broader economic concerns amid trade tensions and tariffs. With President Donald Trump’s trade policies prompting fears of recession, investor sentiment has transformed to panic, affecting tech stocks across the board. Cramer categorized the current market state as one of decline, stating, "There's a lot of panic, and no one ever made any money panicking." He urged investors to remain calm and look beyond the immediate market fluctuations.

On the product front, Apple recently demonstrated ambitions to rejuvenate its lineup with new launches early this year, including updates to its iPhone model, iPads, and MacBooks. These releases signal the tech giant's awareness of shifting market interests and the importance of bolstering its revenue profile against the backdrop of slowing iPhone sales. Analysts believe this rapid product rollout could enable Apple to capture earlier revenue increases, providing the necessary boost for sales. Nevertheless, the cautious sentiment among investors reflects long-standing concerns around market saturation and potential impacts on consumer interest and product demand.

Overall, Apple appears to be caught between successfully launching new products and managing expectations around its innovative features. With the anticipated updates to Siri delayed, investors are left grappling with uncertainty over Apple’s immediate future as economic pressures loom overhead.

Despite the recent downturn, analysts remain hopeful about Apple's longer-term potential, especially noting progress made with rolling out Apple Intelligence features, particularly as they enter new markets like China. The anticipated growth from these developments highlights Apple's capacity for adaptation and potential for recovery, even as it navigates tumultuous market conditions today. Analysts stress maintaining focus on what Apple can offer beyond its current challenges will be key for investors moving forward.